And, as I work on writing out my new series: HACKING CAPITALISM, part of a new toolkit and online course resource, I am thinking about the ever more urgent need to know where the HECK our money is, what it’s supporting, and how to choose to invest and when necessary divest with full information.

Any time we buy something we support the businesses around it, and when we have a bank account or make an investment, our money is on loan to the institution we pick or companies we’ve invested in.

Divestment is removing your resources from places you don’t support, and its counterpart is INvestment — putting money places you DO. Unsurprisingly, this can be harder as the web of corporate evil is thick — but it’s not impenetrable. Below are resources to help you do both.

Divestment

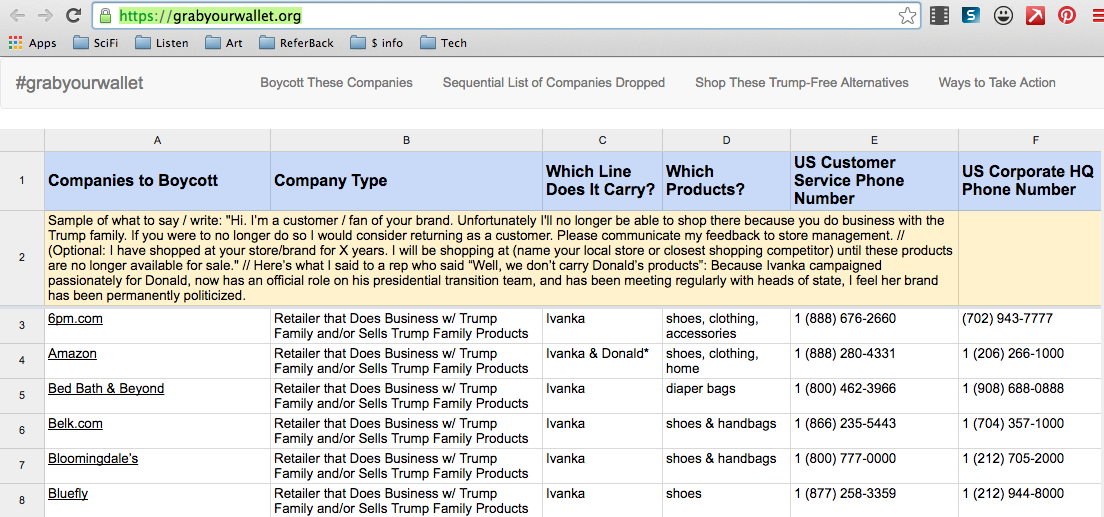

For divestment, here’s a great list of banks that are connected with funding the Dakota Access Pipeline, and here is a list of companies that do business with Trump: grabyourwallet.org.

When you’re choosing to divest from a bank, my $0.02 is not to close credit or other accounts — just stop using them. Keep the account open, just move your activity somewhere else.

Why? Closing accounts — especially credit card accounts — can seriously harm your credit score. Please don’t let your activism mean you can’t get a lease or loan you might need, ok?

Even more infuriating to banks, though, (and good for your credit), you could choose to use the credit card but pay it off entirely each month — borrow THEIR money and give them nothing.

Where to Bank or Invest Instead

BANKS:

Some NYC-centric banks that floated to the top in a recent workshop include: Amalgamated Bank, Brooklyn Coop, The People’s Alliance Federal Credit Union, and Carver Bank — but there are a LOT of great choices. Just make sure it’s FDIC or NCUA insured and you’re good.

Here’s a great list of co-ops and community banks:

- Break Up With Your Megabank: http://directory.breakupwithyourmegabank.org/

- BANK LOCAL, by the Cooperative Economics Alliance of NYC (gocoopnyc.com) http://banklocal.info (bonus: sorted by impact rating.)

If you want to do banking (or anything), go coop! Member-owner power 4ever!! The folks at Break Up With Your Mega-Bank even made a how-to list to make sure your checking account doesn’t become a disaster in the process.

INVESTING:

You want to retire someday? Me too. While it’s not ideal, the current model of doing so requires investing in IRAs. What businesses do the funds in your IRA’s support? Here’s a how-to research what exactly is in your investments using Morningstar.com.

If you’re not pleased with who has your money, consider moving not just your banking cash into credit unions but also investments into funds that support business models you want to see succeed.

Look for Socially Responsible Investments and funds (SRI), and learn about SRI. Amy Domini is a fund manager who co-created the idea of social investing, here’s a neat article about her theory of social investing. Here’s a few resources and how-tos on getting social and sustainable with investing:

- Ride Free Fearless Money: Investing when you hate capitalism

- The Forum for Sustainable and Responsible Investment: www.ussif.org

- Green America resources: http://app.greenamerica.org/fossil-free/

You might be interested in these other related articles: