Friends who are freelancers, artists and work lotsa gigs: To help you be free of the money confusion that being on the hustle as your own boss can generate you can grab a free calculator at the bottom of this page to find out for yourself: how much money did I actually make?!

Knowing literally how much money is coming in — and how much income you need to make in order to to bring home the money you want is so important. As we know, getting a check for $500 does not mean putting $500 into your wallet to blow: taxes, biz costs, heck just getting to gigs will eat away at it.

I ruminated on what I had to learn the hard way when making the Fearless Freelancer Money Skills course, and in I listening to all the issues clients and students tell me about I’m glad to share this free resource with you.

It think it’ll help you start to make sense of your money! How to use it, and where to get it is below.

Being a Number Cruncher

I have to admit something: I’m a stylish geek. I’d wear a vintage pocket protector if I had one and fill it with fact sheets. I find excuses to learn science history and use formal logic in my scratch work.

And, I used to be ashamed of being a number cruncher.

Yup, I used to just quietly do math in my head, secretly file receipts, and dutifully fill out my tax paperwork for my multiple side businesses without much fanfare. It’s all in a femme’s days’ work after all.

But once I started working with other people on projects that required some businesses knowledge? Yup, it became extremely useful to have this DIY MBA. I’d gather up the expenses and dig around for what we spent, make sure receipts were saved, and once I got adept at it, I got our businesses registered and accounts opened.

We all know how it works: you have “someone who does that stuff for you” (in this case, me) and then no one else learns about it. It’s tragic, really. The person who knows how gets overworked and the people who don’t stay uninformed and get surprised.

I have another secret: I don’t love prepping for taxes or managing accounts — but I do it because I know it’s how you level the fuck up and take your biz seriously.

Nah brah, I am in the weeds with you.

I too, have a spreadsheet that I’ve used to do my taxes.

I too, have one too many accounts.

I too, would rather be hanging out in the sunshine with my favorite people than wrangling numbers.

And that’s why I’m good at it, and why I have fast and accurate strategies to get it all done. I love the end result: knowing that my biz has money, which means so do I.

We need number crunchers because we solve problems. I’m about to share a problem-solving strategy with you all because I know we freaking need it.

Solving the Basic Problem: How Much Money Am I Really Getting & Is It Enough?

One of the biggest issues I’ve had and seen others have is trying to figure out how much money a project or gig is going to pay out when it’s all done. Even worse, is it enough money? If I wanted to make MORE money, what do I need to bring in up front to get there?

When we don’t have taxes taken out from money we get, it’s work to figure out how much “take-home money” we get from our freelance, product sales, side hustles, gigs, cash jobs, etc. I know it’s not simple: there’s the check you get from the client, funder or sales platform, but it’s always different than the amount of money you can take home and spend on rent. Obviously there’s taxes, but there’s also ongoing expenses like office supplies and software – oh, and those special one-off things like a new piece of equipment or….dare I say it: an annual deposit into a retirement account.

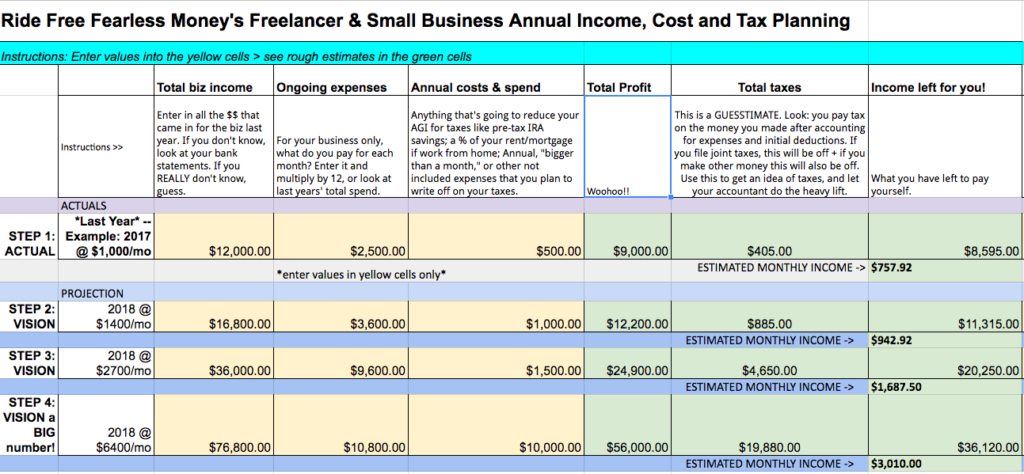

Being a number cruncher, I made a spreadsheet calculator to help with the basic level of this problem. (There’s a link to download this free template at the bottom.)

A live video walk-through of this spreadsheet is here — or, scroll down to download it yourself!

A bit about what this template does:

- It’s set up to look at a whole year at once, but you could use it for one month if you wanted.

- You’ll need to know or at least have guesses on your costs and income. It’s ok to be blurry here, this is not for your accountant. This is for YOU to learn what you take home, and to learn what you have to change to get the outcome you want.

Column C: Enter your actual annual income, or a decent guess if you don’t know it.

Column D: Enter your annual ongoing costs, or a decent guess at what you’ll write off for your business over the year. Your monthly costs times 12 will work well here.

Column E: Enter an annual total for your other spending that’s business related, which you write off. Your new camera that one month, a course here and there, a deposit to your IRA.

Boom – the calculator fills in the rest, telling you:

- Your profit

- Your tax estimate

- Your income – annually and monthly.

This sheet answers a few basic but crucial questions — and lets you forecast next year. VERY useful.

There’s more I know you might want to do, and I have a advanced spreadsheet that breaks down monthly income more clearly, tracks expected client income, and more as part of my Fearless Freelancer course.

Yup, get this new course and all the calculator you can handle + 2.5 hours of video instruction, 48 pages of handout and slide deck step-by-step, and fearlessly freelance onwards!

Answer your freelance money questions today with this course, or just enter your email to grab the calculator below.