Look around: friends it’s education over here, facts over there, and resources up in here. Why? I’m here preachin because I want other weirdos who aren’t so into the current economic system to be as stable in it as possible. If that means financial education that doesn’t suck, explaining what investing is and how to compound an interest rate, so be it. #Getyourmoney.

Recently a woman in my Hacking Debt seminar said she’d taken an earlier class – and it caused her to up her savings game so she’s got her first $1,000 in the bank. She also happens to be over $100k in student debt (like about +5% of borrowers).

At that point you might think If I had that debt I’d be like f&*k it, I’m ordering takeout. But that’s ceding defeat before you even look the thing in the eye. Obviously you can’t pay off a giant student loan in a few months – but if you get up on the things you CAN do? Dudes it gets easier to work on the big stuff. Stay basic, get shit done, go have a coffee. That’s my way and it works.

What this means for the lady in my story is that when the inevitable OhShit! happens in life, she’s got $$ on hand to deal – unlike 47% of Americans who don’t have cash on hand for a $400 emergency. Even if you have debt, you need a little OhShit! fund: whether that’s cash in the bank or parents to call, you gotta know where it could come from — or you’d be $201k in debt. Got it?

My readers know I don’t come from money, but I been putting it in the bank like it’s a job since I opened a savings account at 11. And having a tiny cushion meant I could survive my 20s without credit card debt, and go on to only have a few money mistakes to unpack. (Student loans I’m looki ng at you.)

ng at you.)

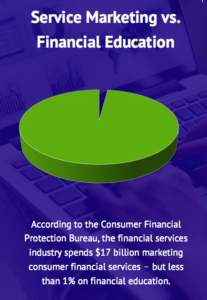

Notice this: financial companies spend $17 billion annually to market to you — but only 1% that amount to educate you. D-A-M-N that’s rude. What is it they don’t want you to know, anyway?

I believe that informed decision-making when it comes to money is totally rad and means you can get out of a pit of stuckness. I also think there’s to learn! So be easy on yourself, do what you can, soak up the education, and go find more.

I read a lot of finance blogs and books, check out the resources page for a list.