Picture it: you’re paying off instead of adding to your debt, you’re leaving the house with more than $10 for the day, you’re seeing black and green and – are those four digits?! in your bank and emergency savings account. You realize you have gotten stable in the present, and now it’s time to start getting the future set up.

Here’s how to think about investing and a few ways to start.

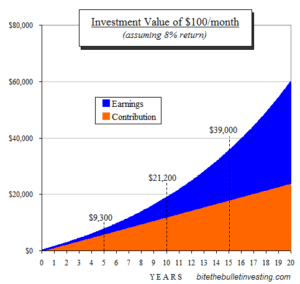

The #1 rule is: time is part of the equation.

So, it’s better to start with a smaller amount of money you have access to sooner, than wait to invest until some larger raise/bonus/windfall/inheritance that may or may not come later. Figure out what you can invest TODAY, and do so.

You can have pre-tax or after-tax IRAs (retirement accounts) of various kinds, and/or you can just go rouge and have an individual investing account. No matter what kind of account or accounts you decide to start — that’s a separate logistical issue, really — first, decide what you can pay your future self out of today’s income, and prepare to start doing so ASAP.

This author’s sample investment plan image above demonstrates $100/mo earnings over 20 years. The catch: delaying 5 years doesn’t mean you lose the first 5 years of income — it means you lose the last 5 years, where you really start to see payoff. Start if you can yall!

Get the Money!

One strategy is to transition the amount you’d been paying to a credit card or student loan, once paid off, towards an investment.

Another strategy is to (please!) take advantage of an employer’s retirement matching if available to you – if they’ll match 2%, put your own 2% in. This is one of the few instances of free money (technically you are working for it).

If you don’t have a lump sum to dump into a fund and want to make monthly contributions, make sure to look for no-load investments so you’re not paying a fee each month to buy in. If you plan to just drop a (few?) grand once a year, then paying a one-time purchase fee isn’t a problem. It’s just about thinking through how much of your money is being lost to fees each time you invest.

Wait, wait I don’t know if i have money after all! Try Automatic Investing

Acorns is an app I that rounds up your purchases to the nearest dollar. It’s a bit invasive, but if you: make a lot of transactions per month, think you’ll have $50 or more to spare each month, and are otherwise not sure how to “find the money” to invest, it may help you determine the amount you can spare — then get the heck out of the app and invest it strategically.

The #2 rule of investing is diversify what you invest in.

Stocks, bonds, mutual funds & ETFs are essentially all ways to buy in to countries or companies by loaning them money. Because this is an unstable and changing world (to say the least), you don’t want to put all your eggs in one basket.

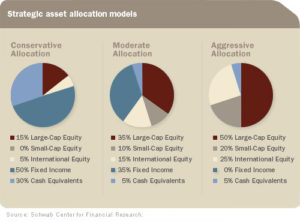

For each investor, you’ll have a different set of considerations about what kind of risk you want to take with your money (and your timeline to retirement is part of it.) Read up on risk, asset allocation, and diversification, and come up with a rough percentage for YOU that feels smart and secure enough.

Here’s an example asset allocation model that’s taking into consideration how stable you want your investments to be versus how much you want to ride the market to hopefully make more money over time:

Where to Invest

Ok, you know TO invest, that you have some options, and have identified the funds. Now, where the f*&$ do you actually put the money?

Into a brokerage, which is to your investments as a bank is to your checking account. There are in-person shops, Online brokerages, and

Online Brokerages

When do you feel ready to put money away, web portals like Betterment.com and StashInvest are online brokerages that help you manage your investments with some neat digital interfaces and low fees.

Additionally Vanguard offers online purchase of ETFs that while it’s a big-name firm, due to the overall low-cost will essentially be an online discount experience.

In-person Brokerage

So you want to be able to see and talk to a human in this process? Totally understandable, though of course there’s a cost to everything. You can have a person you work with directly to whom you pay a small percentage fee of your money, or you can have an account with one of these places without having a specific broker working for you and still have the ability to call someone and access their resources. Just call or sign up online. Some of the big names are Charles Schwab, New York Life, Fidelity…

Online Wealth Management

And once you’ve really started to level up, places like StashWealth.com (run by a super smart woman of color) or Ellevest (also woman-owned) are ready to help you, for a fee. My general recommendation is once you’re over the ~$50k mark in investments or savings, getting some outside perspective is worth it. But, do what feels right to you, and if that means getting advice sooner, go get your money.