The more I talk with people about their concerns with their money, the more curious I’ve become about debt, so I put on my scholar hat and did some research…

In short: formal “owsies” have a shady past that pre-dates capitalism and is linked with colonization.

Global History

In Debt: The First 5000 Years anthropologist David Graeber traces debt back to 3500BC and makes this timeline of starstudded appearances: debt & credit, then money, then barter. What a cast!

Graeber sees the longtime “indebdtness of human economies,” (eg I give to you, you give to me, a/k/a COMMUNISM) as contrasted against the rise of “mathematically precise, firmly enforced debts” and clocks widespread impoverishment and violence as common results of the latter. Graeber even defines the former as an an “everyday communism” – shared responsibility grounding collective indebtedness. (Journalist Richard Swift uses the term “ethic of reciprocity” which those of us familiar with anarchism might call “mutual aid”.) Anyway olden time credit systems were based on these social currencies: I trust you because we live in the same village so I’m sharing my amaranth harvest.

Then we get the so-called great eras of Greek/Roman/Mediterranian/Chinese/Indian-continent expansion, where certain people enslaved a lot of certain other people and the concept of taxes which the rotating cast of rulers wanted for wars and domination begins. Taxes (and soldiers) got paid in coins so they could go across the various cultures…taxing and soldiering. Cute look, history!

Then there’s a 1000 or so years of general quietude, slavery was kinda abolished, and conceptual money-exchange remained in use in IOU form as people returned to tasks like inventing paper and tending the commons. In Western civilizations, Churches ruled and had a moral ban ursury, the practice of lending money at unreasonably high rates of interest — or rates of interest at all (I’m looking at you shady subprime lenders Countrywide Financial Corp., Ameriquest Mortgage Co., New Century Financial Corp., First Franklin Corp., and Long Beach Mortgage Co. Tell me more about your god. citation).

US History

Next – you may not be shocked here – Graeber connects the colonization of the Americas and the Atlantic slave trade to “stimulate the reemergence of the bullion economy, and large-scale military violence.” So the need for a way to accumulate and transport wealth — and to BORROW wealth to go on colonizing expeditions — reinstated a non-socially-bonded figure to represent money.

Moving into more recent history, in the 18th and 19th centuries, credit functioned as social currency: asking a store for credit and it being granted on a personal basis, and repaid on the knowledge that if you didn’t, you couldn’t return to that store (perhaps the only in the area) or get credit again if you needed it. Moving into the era of America’s industrialization, store credit was also given out as a means of entrapment. Company stores in mining towns made sure that a gap naturally existed between the cost of their products, and the wages that they paid out.

Credit Cards

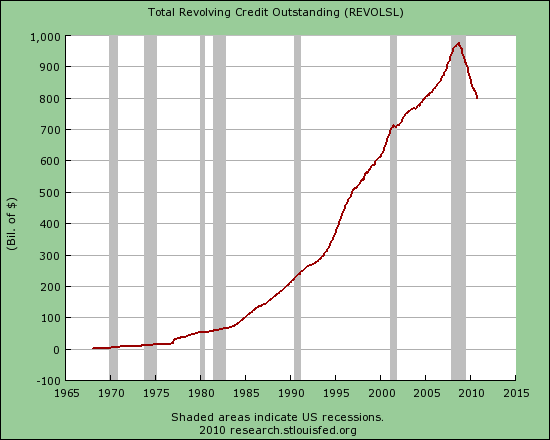

“The first modern credit card was only established in the US in 1958, and it is only since 1980 that the usage of them has taken off,” says this article.

Why? Well, through the 1970’s ursury laws [remember?] kept banks from being able to charge interest over 12%, which limited their profits, especially because inflation was super high in the 70s. If I borrow $100 this year, but when I pay it back,

that $100 only buys $80 worth of stuff now, that $20 change is due to inflation. (Inflation is also why you’d want to save extra money to retire on). And it means that you’d want to charge me $20 to keep up with inflation, and MORE than $20 if you wanted to make a profit off of our transaction.

[Pic credit].

In the 1978 Supreme Court ruling Marquette Nat. Bank of Minneapolis v. First of Omaha Service Corp, this situation changed allowing banks to use the interest rate cap in their state of registry, not the consumers’ state of use. Guess which states had no interest cap and got some new residents? By 1980 Citibank led the rate hike, started charging 20% and credit cards as we know them now took off.

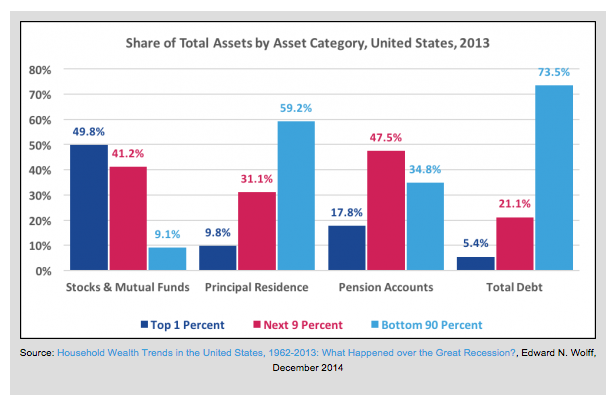

And so we in the US find ourselves, in a super-wealthy country, where 90% of the population carries 73.5% of the total debt (though much of that may be reflected in their principal residences eg mortgages).

So: formal “owsies” have a shady past, made all the shadier by profit-crazed capitalism. If that doesn’t help inspire you to pay off your credit card debt, maybe this handy how-to I made will?

************

In a report I’ll never write: the history of debt collectors: from debtors prison to intentional psychological torture.

And in a further article I won’t write: Who’s responsible for the sub-prime mortage crisis? Few writers come out and say Duh, The Lenders (these folks do)

In fact it’s fascinating to see WHERE financial blame does get placed. In this article, which I reference above, the blame is placed on the PROFIT OPPORTUNITY for lenders created by Freddie Mac and Sallie Mae’s underwriting of sub-prime mortgages. That is to say, it’s as if it’s assumed that the lenders have only responsibility to generate profit, and none to the stability of what they enact or the, you know, LIVES of the people involved. And, in corporate capitalism, that is exactly the case. Thumbs up whoever set this up, you really made a freaking mess.

One thought on “A Brief History of Debt”

Comments are closed.