Ever feel like you’re just not getting anywhere with a financial goal or problem? You may be going about working on it wrong — and designing a different approach could help you get the traction you want.

In order to have the financial outcomes you seek, first aim to make better financial decisions. I imagine hearing you say “duh!” — but most people aren’t making money decisions based on their current situation.

Instead, many people use old habits from former financial realities or random bits of information gleaned along the way, which can only take us so far as our lives change. When we pair that behavior with the increased complexity of new life experiences (partnership! careers=income changes! Kids! Social and climate change!), our old-school methods can fail us, compromising both our financial futures and our current values.

There’s a slew of ways to make better decisions. The one I apply and teach most often is design thinking because it helps us make decisions faster, focused on what’s valuable presently.

This article summarizes a few design thinking methods that apply to personal financial decisions — I’ve used them with clients, taught them in workshops, and this guide aims to synthesize them into writing.

As both a financial educator and design strategist I spend a LOT of time observing and improving decisions with people.

Over my career I’ve grown parallel paths: one, as a progressive personal finance educator, and another as a human-centered designer. As I’ve gone deeper into both roles, big crossovers in methods like design thinking, frameworks like behavioral economics, and the importance of strategic decision-making stand out to me.

I am fascinated by decisions about money, which are ultimately decisions based on our understanding of systems and relationships — economic and exchange systems, relationships with others, and our relationship with our own sense of value and values.

First though, what is design thinking and why incorporate it into the yarn ball that is personal finance?

Design thinking is a way to identify and try out high-impact ideas that truly matter.

Design thinking uses stories and data as evidence to help identify your most important problems. From a design thinking perspective, it’s critical that you understand the problem you’re trying to solve and not just operate on automatic or from old assumptions. You’re invited to first understand context and figure out what issues are at play, in order to prioritize them and then try out increasingly-informed solutions.

This initial step of understanding the situation and identifying the right problem is SOOOO important, I made a 30 minute class just to walk people through the steps of it.

In brief: instead of just throwing everything against the wall, being (rightfully) overwhelmed, and then giving up, with a problem-exploration approach you:

- Examine what’s happening holistically and tease it apart creatively,

- Focus in on one important and relevant aspect to start,

- Then you try one thing to address that issue.

While this might sound simple, this is not how most people approach personal finance.

A much more “normal” approach to addressing financial questions approximates dumping everything that worries you about money onto the floor, closing your eyes and picking one up, looking at it and thinking, “THIS? I don’t know how THIS works! But it definitely isn’t working, right? And it reminds me of how wrong I’m doing money… Is there anything on Google about this? [enter two hour wormhole]. WHAT I’m supposed to have 3x my salary in the bank and never eat avocados? Forget it!”

Don’t be normal. Be strategic. Let yourself make little, better decisions.

Design your money management decisions with at least as much attention as you give high-value purchase decisions — and overwhelm can transform into a sense of control. Below are five ways to use design thinking to improve your relationship to money and your systematic approach to personal finances:

- Find the right level of problem to work on

- Don’t work on symptoms, work on problems

- Break your cognitive biases

- Prioritize with facts and then feelings

- Test and learn

FIVE DESIGN THINKING EXERCISES FOR PERSONAL FINANCE

1. Find the right scale of problem to work on. If you’re trying to solve for all the inequalities of capitalism with your everyday budgeting, you have identified a real problem, but you may be working at an inappropriate level to solve it.

If you were examining your personal financial situation and observed that, say, as a first generation college student your debt burden is high, you might identify generational poverty as a root problem (and it is, for many people) — but you wouldn’t then go on to try to solve generational poverty en masse. You would identify ONE little part of the issue, and try to solve it. For example, you might identify “getting more income” as a specific facet of generational poverty to address, and you might try doing it for yourself as a way to impact the debt you’re paying down currently, or support a friend or family member in increasing their income.

In design terms, this is you applying an intervention using a systems approach. Which is wise but can be tricky.

Lots of folks correctly identify systemic issues affecting them — student debt, extractive profit practices, wealth inequality and so on — but then get stuck at them high-level because these are massively complicated problems. The trick is to identify something that will make change, *that you can do*.

Try: Cupcake / Birthday Cake / Celebration cake idea generation. Once you’ve identified a systemic issue, take 10 minutes to list out ways you can address it *at three levels*:

- Cupcake solutions are little tiny things you could do this week (set up a savings account with an auto deposit).

- Birthday cakes are ones you could do in 6 months to a year (get a new job).

- Celebration cakes are ones you’d try once or twice in a lifetime (write a policy or start a business to address the issue).

After you do that, pick one from the cupcake list to start with and do it ASAP. You’ll be shocked at how good you feel by getting started, and the impact you can have from a little, everyday change — even if it’s not immediately addressing the whole issue.

***

2. Don’t work on symptoms, work on problems. Similarly to the example above, with finances I often see people working on what a doctor might call “the presenting problem” — what’s showing up and causing you pain.

However, that’s often caused by an underlying issue.

For example, when folks have persistent debt even when they make decent money, the issue isn’t actually debt, it’s a cash mismanagement issue: consistently spending more money than you make. You could get a windfall and pay off the debt and yet end up in debt again very quickly because you didn’t solve the problem, you only addressed the symptom.

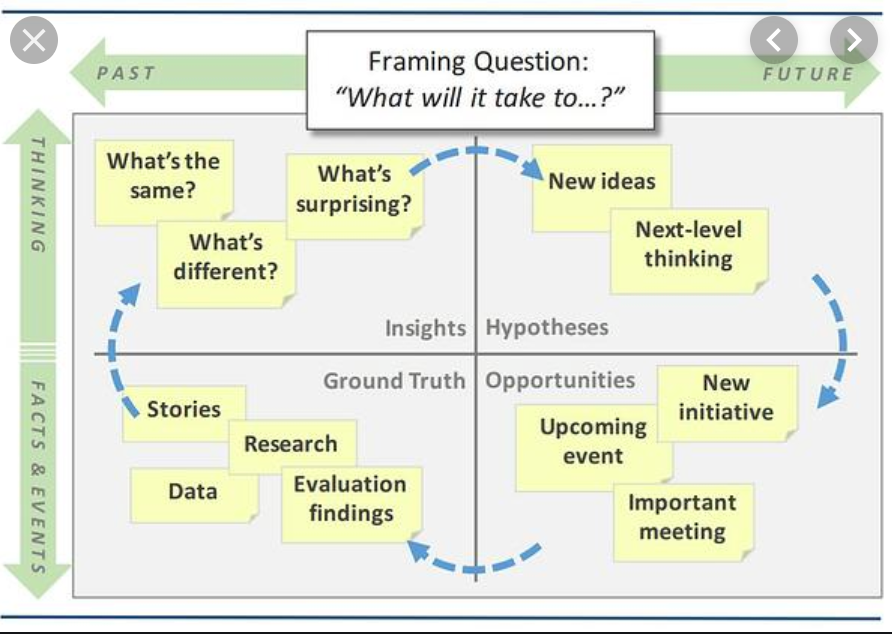

Try a question from Emergent Learning, “What will it take to…” — for example:

What will it take to stop using debt?

What will it take to pay off my credit cards and never use them again?

What will it take to cover my income and spending needs?

Or try…

After that, notice if there’s any deeper facets of the issue you uncovered, and if those help you point your solution-seeking in a new direction.

****

3. Break your cognitive biases

The likelihood is high that you’re unknowingly making decisions and acting from a place of bias based on your beliefs, mental models, timeline, and past choices. It’s not a personal failing: we all do it. Cognitive bias is a widely-studied phenomenon that gets in the way of all kinds of good intentions and rational decisions.

Often I observe people hold different standards of belief and action for, rationally, what is the same object. For example, so many of my clients feel:

- Uncomfortable contributing to what they perceive to be the worker exploitation and tax avoidance of Amazon, so they don’t want to own Amazon stock yet many will still buy from Amazon (here’s one list of alternatives, btw).

- Resistant to the idea of supporting Big Oil businesses, like banks or oil companies, who profit off pipelines or who produce negative environmental impacts (here’s a site to find better banks), yet use cars or have mortgages with these companies.

Sidestepping the source of these biases, the emotional tenor of these outcomes is clear: it’s permissible to give these mega-companies money, but not to make or receive money from them.

There are (at least) three cognitive biases at play here causing this:

- Parkinson’s Law of Triviality, eg given a list of issues, we tend to give the least attention to the most complex and the most attention to the most trivial. Is it really more important that you never earn one penny from a cause that goes against your values, as compared to the long-term effects of, say having lots of money to donate or not having enough money when you’re old?

- Hyperbolic discounting, eg the reward I can get sooner is preferable to a bigger reward I can get later. This tends to show up in regards to investing and delayed gratification practices in general. The virtuous self-image one might reinforce from avoiding investing due to a perception that it’s “bad” is a quicker positive reinforcement than the long term gains available from a systemic approach to understanding and selecting (more) ethical investments.

- Finally, mental accounting is a behavioral economics concept where we assign categories to our money to aid in comprehension: I look at how I spend like THIS and how I get money like THAT and how I keep money in THESE ways.

Breaking our mental biases is an ongoing growth challenge that requires you see your everyday in new ways.

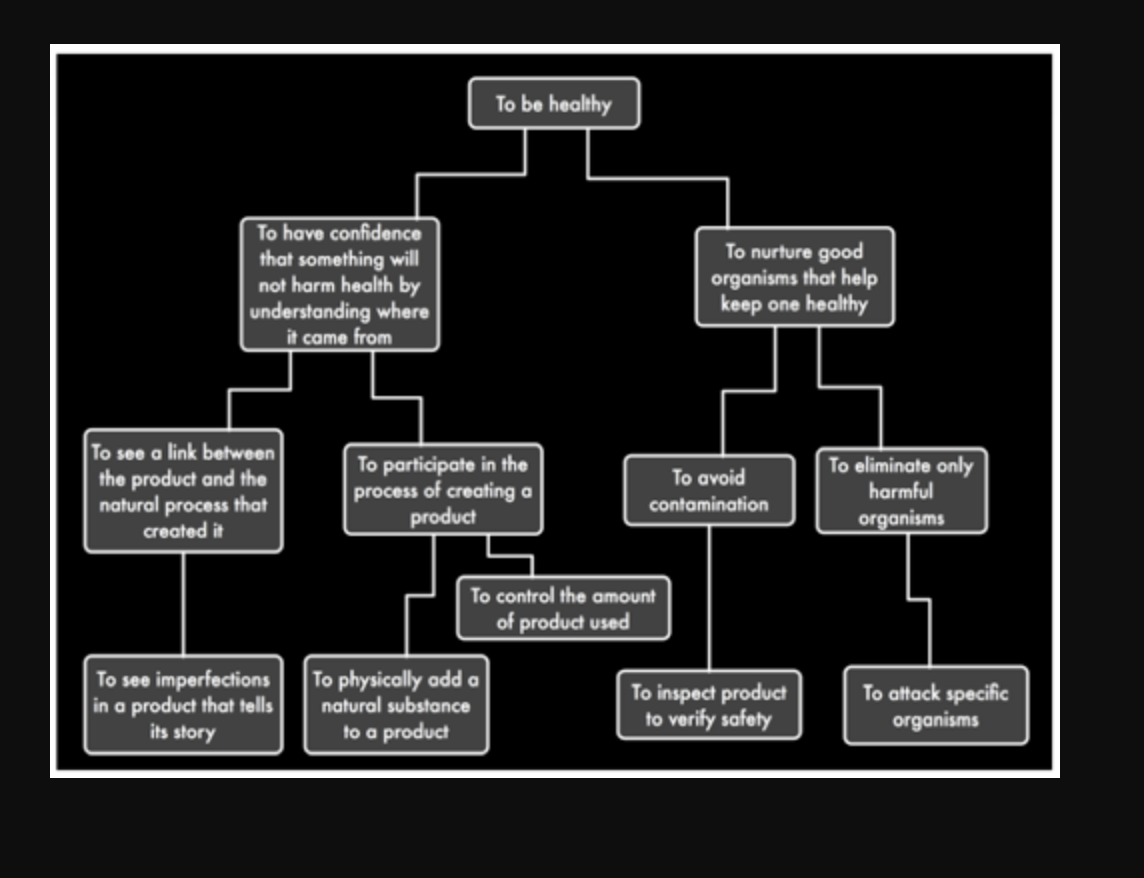

Try: a Why Ladder — when you’re considering what to do about a problem that reoccurs or sticks around, it’s worthwhile to ask a few deeper questions to refocus on a new part of the issue and reframe the problem. For every answer, ask yourself “why” again to dig deeper. An example:

Why do I make the spending choices I do?

Why is that happening?

Why is it important to me to address this?

Why do I care?

Why?

To dig in more to breaking thinking patterns, check out this 10 minute video giving you a deeper set of exercises.

****

4. Prioritize with facts and then feelings.

The next problem I see people encounter in trying to sort out their finances and make good decisions is treating all information with equal importance.

Everything matters — but not everything is urgent or the most important. Your task is to find something impactful and worthwhile that you can work on without getting lost in the details.

While that may seem difficult, it is less so once you give yourself the gift of mapping out your priorities.

Remember that your assumptions and biases can lead to misguided actions. Ever hear the phrase “feelings are not facts?” It cuts two ways: our feelings absolutely inform our actions and decisions, and color our personal stories — yet, they are not necessarily correct.

In fact, feelings and beliefs often misguide us. This is behavioral science in a nutshell: feelings are not facts but we decide about our lives as if they were, so plan on that. To learn lots more about this phenomenon, watch Dr. Tali Sharot’s TED talk on optimism bias.

Try a Prioritization Grid (a fancy term for “make a list and order it”).

- Take 10 minutes and write out your goals (not your problems, GOALS are the things you want).

- Then, map your goals up-to-down the chart in order of most important, high to low. Critical: Nothing gets to be equally important, every goal is more or less important than another goal.

- Finally, move them from left to right in terms of how feasible (that is, how “doable”) you feel this is to address. Try asking: “Could I technically make a move on this tomorrow?” Money brings up everything from confronting your deepest fear to getting over your dislike of saving passwords and facing systematic oppression. You’ll know what you are ready to take on best — just map it out.

To learn from this map, look at the top right: that’s what’s most important AND doable. Ask yourself: “What’s the problem getting in the way of me working on this goal? What could I try to address this?”

Feel free to be basic!

If your top goal is “save up for a car,” the problem could simply be “I have no money saved up and I don’t know how to save it.” Your thing to try could be as simple as: I will do one thing to save money next week.

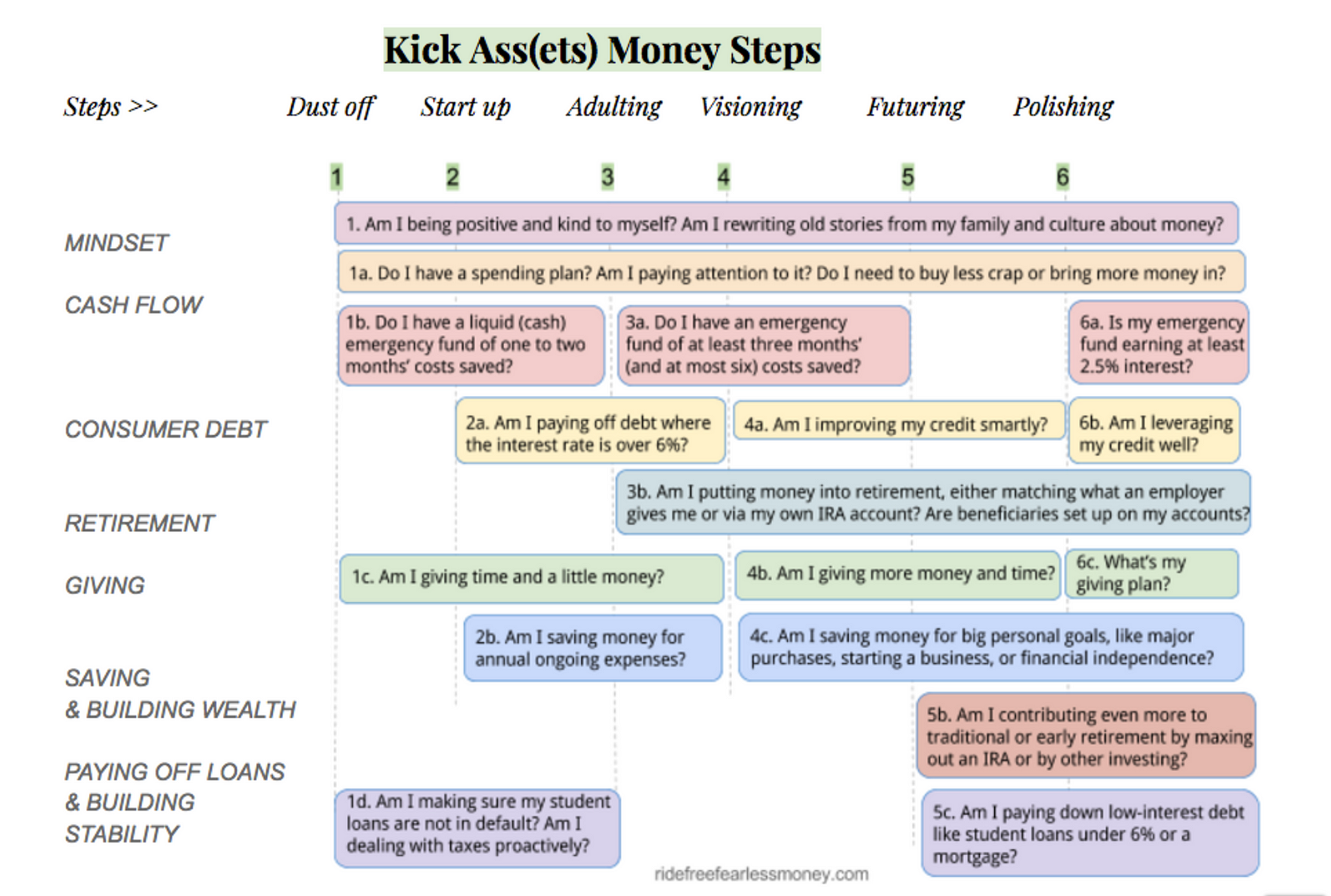

To jumpstart your thinking about financial goals, I made a map of common goals and ordered priorities many folks have in regards to personal finances. Remember that your goals might be different, so adjust as needed for your reality.

***

5. Test and learn. Remember that one time you learned everything about how money works? Yeah, me neither — no one was formally onboarded to money, and few of us got practical financial how-to.

Often it was either “don’t worry about it” or maybe “here’s a savings account, use it,” until BOOM maybe you had a teenage job, and then BOOM student freaking loans — or worse, someone else handled all your money needs until SLAP here’s your first paycheck — good luck!.

That’s a pretty steep learning curve and it can feel like it’s happening quickly, without guardrails.

To walk back from the cliff edge of overwhelm, it can be useful to remember how learning works. We all have pieced together observational, experiential, and narrative learning into a quilt of practices that may or may not be doing a good job for each of us in the current day. What I needed to know to manage my teenage after-school job money is vastly different from what I need to manage a salary and side hustle now, for example.

Try: Write out simple plans to “test and learn” from. A design-driven way to advance your learning about money is simply, be intentional about what you’ll do and why, for a time period.

- pick a problem to solve related to a goal,

- research ways people deal with this (be efficient about your research time, pals),

- decide on a thing to try,

- identify what you think the outcome will be,

- and then go try it and see if you’re onto something.

For example, if you want to save money for a big trip, you might research and then decide you’ll try putting an automatic savings round-up tool like Quapital or Digit onto your account. Two months later, you check in and notice WOW! I saved $500! — now, you see you’re moving towards your goal and can make an informed decision to move forward on.

Or, to go back to our generational poverty example: you might decide you want to try “teaching others from my community how to save money” as a next step to address the problem, and then you’d want to come up with a specific way to try doing so. Outline a clear person to impact and one thing that will indicate your impact is landing.

I like using a madlib when I’m trying to make a plan like this. For example:

“Because ___(problem to solve or goal to achieve)____,

I think if I try __(thing I’ll do)____,

then ___(what’ll happen)_____ —

and I’ll know I’m on the right track when I see ___(what’s starting to happen)____.

The systems and processes around money are only made all the more complex by our relationships to all that money represents, and the intersections of our identities which provide tangible blockades or secret support systems.

Like anything we interface with regularly, money use becomes routine and habitual, even for those of us committed to intentionality and purpose otherwise in our lives. Have an old account at a bank you don’t respect? Wish you could cancel your Amazon? You’re not alone, and you can make these changes.

Seeing people struggle through all kinds of decisions, I have a current hypothesis: that money decisions are hard simply because nested *decisions* are hard.

But, like you saw above, we can use the same tools that support multi-variate product design decision making. And I believe this will help money decisions should become easier. I’ll know I’m right when I see more people make decisions and take action on them, or ask informed questions that indicate they are learning into a decision.

My current pilot for this hypothesis is a decision-making guide to support ethical investing and socially responsible spending; something I get a LOT of questions about and which, as a values-driven person myself, I have a lot of interest in. That guide, and a workshop on it, are available in early March 2020.