Start off with your next money step!

It’s time to slow down, take awesome care of yourself, and start your money journey off with excellent practices and plans. And the best plans? Ones you know how to move forward on!

I’ve heard from you all that it can be really hard to know what the next money step is to take. I agree: there are lots of dependencies and individual variables.

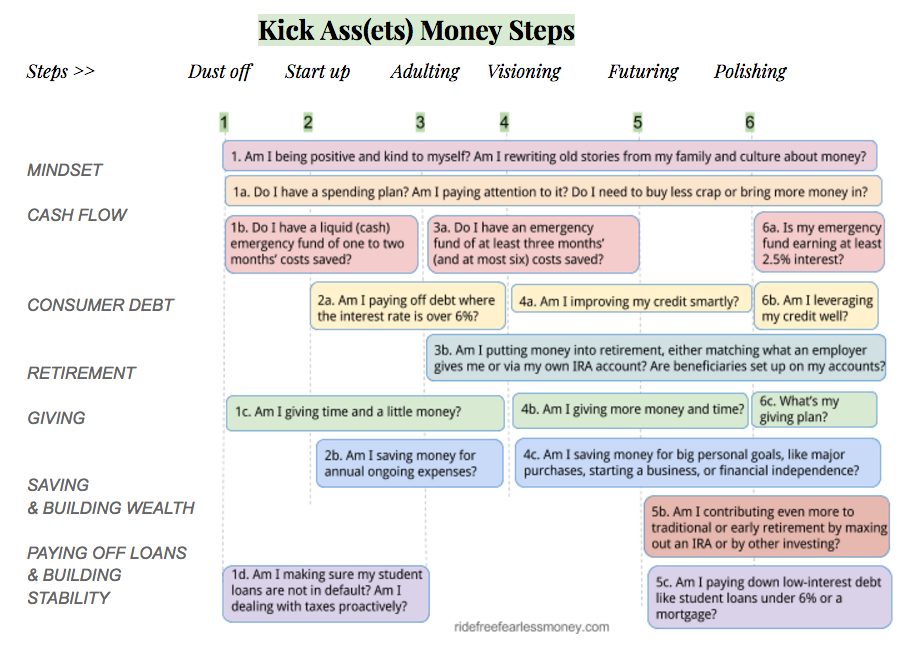

To help you clarify, I created a simple visual guide to take you through six steps: Dust off, Start up, Adulting, Visioning, Futuring, and Polishing.

It goes deeper though.

Within each step, the things you’re working on along the way are: Mindset, Cash Flow, Consumer Debt, Retirement, Giving, Saving/Building Wealth, and Paying Off Loans/Building Stability.

What the steps look like in practice

The goal here is to give you a sense of the kinds of things to work on, what order, what’s ongoing, and how to prioritize. Here’s a snapshot of the whole Steps Guide:

Ongoing along the way > Money mindset matters: Want some new years’ stress relief? Stop beating yourself up about choices in the past, no more listening to crappy old money stories from your family, and look your finances in the eye. It’s your life, your money, and your time to care for yourself.

Step 1 = Dust off > It’s time to get started. First, your cash flow wants your attention. Make a spending plan, any one will do. Download my free guide, grab an app, write it in paper – the important part is that you wrap your head around what’s going in and out of your bank account and wallet, and are aware if you need to tweak anything. This is also a the time to start to examine where can stop paying for crap you don’t need or enjoy (an ongoing practice here in capitalism to be sure!), or if you need to get real and bring more money in somehow.

Now this is important: Your next step is to start to get some savings put aside in case of emergency, to keep you from getting into debt. Start with a goal of $1,000, and aim for 1-2 months of all your costs saved up. Try a savings account that’s not your regular bank account for maximum save-osity. Next, get aware of if you’re giving a little time and money or a LOT. Is what you’re giving sustainable and ok for you? And finally: Do you know if your loans are in good standing or default or what? Are you making scary phone calls if needed or getting support around things like back taxes (ps just start with filing the most recent year)?

Step 2 = Start up > Once you have started gathering some emergency savings and understand your money ecosystem, then you will know enough about where your money is going to be able to find ways to start paying off any high-interest debt you do have. If you’re being charged more than 6% in interest, it’s most cost efficient to pay that off than to start knocking down retirement or long-term savings goals. This is a good time to also make sure that your annual expenses (insurance, holiday spending, travel) aren’t knocking you back into debt, so make plans to save for them — or cut them until you’ve paid down your debt. Opening a separate savings account or trying out Digit or Quapital can help you save if you’re really stumped on how to save.

Step 3 = Adulting > Once you’ve gotten a baby emergency fund set up and made a dent in your debt, then start saving for retirement. Experts vary in agreement here, but in general if your employer offers a match, at least contribute enough to take advantage of that — even if you are still paying debt or building more emergency fund since it’s “free money” (I mean, you have to have a job to get this “free” thing, but still). If your job doesn’t offer retirement, set up a personal IRA, ROTH IRA, or SEP IRA if you have your own business and put in the annual max of $5.5k if possible. No matter what kind of account you have, make sure the people you want to get your money when you die are listed on the account as beneficiaries. This is especially important if you’re not married and/or your legal family isn’t so cool.

Step 4 = Visioning > Once your high-interest debt is paid off, then you can start doing more donating and sharing money. That’s also the time to start allocating money into savings or mid-term investments (ones that have risk indexed for a shorter time horizon) for your long-term goals. It’s SUPER energetically important to name and vision your savings goals – like for a house, a biz, an RV, insemination, etc. Whatever it is: give it dignity and place in your future by giving it an account and a savings plan. Finally, now is a great time to reinforce permanence on not having debt hanging around by setting up auto-payment on your credit cards to pay the full amount off monthly. It’s a great way to build your credit and get points on cards.

Step 5 = Futuring > Once you have emergency savings and high-interest debt paid off, and have set up some retirement investing and both annual cost and long-term goal savings, then you will have a great sense of your finances and be able to set up plans and put money to work for some of the bigger personal finance buckets: paying off the BIG things and saving LOTS of money towards the day you don’t work anymore. This is where you’d max out a 401k (up to $18,500 in 2018), allocate no more than 10% of additional investing money into stocks or cryptocurrency, pay extra on a mortgage, pay extra on low-interest student loans, or save for an investment property or straight-up index invest your way to financial independence. You might get here after a raise (or two), once you have passive income or side income coming in, or after a partnership, inheritance, or move allows you to greatly reduce costs and free up income towards these goals.

Step 6 = Polishing > At this point, the money flowing in and out of your life should make a LOT of sense to you, and will be very intentionally allocated and probably working pretty hard for you. This is the time to make sure it’s working as hard as possible, including: ensuring your emergency fund is keeping up with inflation (~2.5%), that you’re leveraging your assets and credit so as to maximize returns and build stability, and that you’re giving and sharing the money and time you have as mindfully as possible. Download a Giving Plan Guide here if you need support on that.

Steps 1- 6 go in chronological order: start with Step 1 Dust off and go from 1, to 1a, to 1d vertically down the list. Once you’ve fully started on the tasks in Step 1, you can start working on Start up Steps 2a and 2b. Notice you finish step 1b before you start Adulting in Step 3, and finish 2a before you start Visioning in Step 4a and 4b, and so on.

Try it yourself

I hope this visual is a helpful guide, but all guideposts need to be checked to be meaningful, so pin it, bookmark this post somewhere you’ll return to it, link to the Kick Ass(ets) Money Steps guide image here. … heck – look at it once a month when you put your money hat on and ask yourself what step you’re in and how it’s going.

Feel free to grab any of the resources above to help you, reach out if you want some 1 on 1 support (it’s around Step 3 or 4 that custom coaching or group support like the Hacks Lab can be helpful) — and look out for a full Fearless Money Management course on Steps 3 – 6 coming soon.

pps/ a thank you to my product manager friend BCT for the idea of a product roadmap visual!