Be ready to talk about money.

Talking about money with the people we care about can be amazingly helpful, and it can bring mixed results and challenges. Why? Money is not neutral, and our money realities are not shared.

When we get real with people, money is in the picture.

Our financial realities, money stories, and economic experiences swim around us and tend to bump into other people’s ways of doing things.

Why? Each of us has a unique approach to money, informed by lots of things.

Sometimes we’re aware of it, sometimes we’re not. Usually it only matters to us when we’re trying to make a positive personal change or are experiencing rough financial times. But, our approach to money also stands out when we want to do things like:

- Move in with a sweetie or friend and share household costs…

- Buy a house, RV, collective art space…

- Save up to have kids with our co-parents…

- Plan to take a vacation or take the band on tour…

- Think through taking care of and ~gasp~ retiring with someone(s) as we age…

Making plans together – whether with a romantic or platonic partner, a roommate, or a collaborator – is a GREAT way to see those plans through. It makes it more fun! It makes it easier on all parties! It … makes the paperwork more intense…!?

It means you need:

- self-knowledge and ways to show up to conversations that may be challenging or just plain complex

- a practice of talking about things that lets you be be real, honest, and stay on the same page

- explicit plans and agreements, even when the plan is “we need to learn how to make our plan”

- a feeling that the light at the end of the tunnel is gonna be that soft, rose-tinted light that makes everything lovely and the story end happily

Wonder how to get ready to talk about money?

I’ve got a secret that’s not gonna surprise you: it starts with … you.

Taking some time to really know how YOU tick.

Why YOU do what ya do.

Where YOUR money stories and habits come from.

This, friends, is why I’m thrilled to be sharing a few things.

1) Practice: Get Ready to talk about money

Learn strategies and tools to get ready to talk about money, from the perspective of building intimacy and resilience to capitalism in our relationships.

Learn strategies and tools to get ready to talk about money, from the perspective of building intimacy and resilience to capitalism in our relationships.

Thinking deeply about how and why we act as we do around money can reveal our core values, unearth hidden assumptions, and help create valuable self-knowledge.

With that self-knowledge, we can be kinder to ourselves about money, and show up more honestly with people we care about.

Being able to do that means we can build stronger relationship foundations, grow intimacy, and create workable plans involving money and other people.

Woohoo! As a teacher, I’m here for that – how about you?

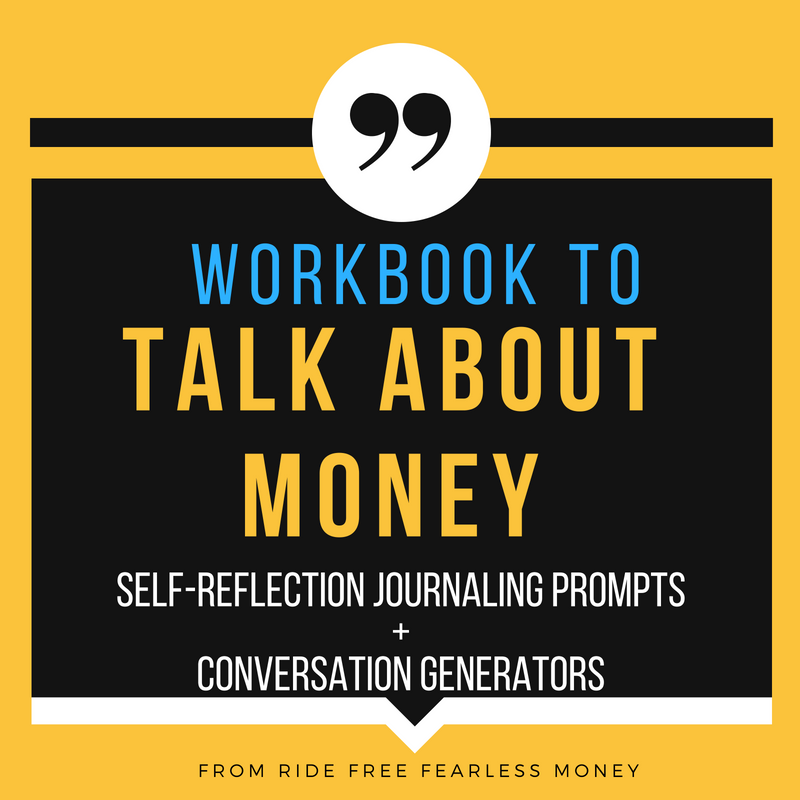

Guide to Talk About Money

This guide is great for: individuals who want to get real and journal out some money feelings or create a shareable, coherent money story; couples who want to include money experiences and approaches in their ongoing conversations; roommates or collaborators who want to talk through economic differences.

This 30-page digital PDF workbook contains:

- 10 journaling + conversation prompt worksheets you can use today to understand yourself or with a loved one

- 60+ thoughtful questions you can ask to deepen your self-understanding on money

- 30+ conversation starters designed to build intimacy and honesty

- A guide to having brave conversations

- Real talk, inspiration, and a DIY self-coaching toolkit!

Click the button below to grab the PDF with worksheets now!

2) Apply it: Talk About Money in a Relationship? YES.

If you’re ready to dive deep with someone, the Partners Make Peace and Plans with Money Toolkit might be just the support you’ve been looking for.

This toolkit can:

- Give you a clear path to start, create, and maintain a system for using money with people you care about.

- Help you define and test solutions and approaches for the shared goals you have

- Know, understand, and deepen respect for the various ways you and other people approach money

- Build mutual agreement on the things you will do

- Let you skip over a bunch of couples’ therapy sessions, fights, and awkward emails.

Get the Partners Make Peace and Plans with Money Toolkit today!

3) Try it: Mini-Guide to Talk About Money

Enter your email to download a worksheet and mini-guide!

Use this guide to help you better understand your relationship to money, your financial situation and needs, your hopes and your dreams, and your habits and assumptions, so you can bring that information into making really awesome money plans that truly work for you and the people you’re building with.

4) Watch it: Mini-Guide to Talk About Money

In motorcycle safety class they teach a useful framework for preparing to take a ride on your bike:

Check out this video, where you learn why it’s crucial you get ready (can someone say self-knowledge, consent and transparency?) and get some prompts to start you off.

- Am I ready? (what’s my mental state?)

- Is my bike ready? (what’s the state of the mechanics?)

Notice that before you go through the technical safety protocols, you have to start with a personal question. To begin an endeavor that has possible pitfalls, you assess and prep yourself first.

Similarly, when you’re getting ready for a convo about money, your first job isn’t to talk about money (you’ll get there – don’t worry). Your first job is to look at yourself: what do you think? What are you like? How do you feel about your relationship to money, your money, and to having the conversation?

SELF-HONESTY FIGHTS SHAME OGRES & SILENCE SPIRALS

One really important thing in doing the self-assessment is to be honest — That includes being honest about privileges that you have, the nature of your current situation, and your expectations about money you’ll need or get in the future.

When we don’t self-assess honestly, we struggle to share honestly and don’t own up to our full experiences, which makes our trust bonds and shared plans less strong. The best thing you can do is to just describe, be honest, and try to share as best you can with the people you’re having the conversation with. Everyone appreciates that, especially because…

The most important thing to remember is: no one picks how they’re born. That includes the family and economic situation you’re born into. There’s no shame in being born with access to resources, just like there’s no shame in being born without access to resources. You can’t pick it. There’s also no shame in having and wanting or not wanting / having resources, spending, savings or debt. Let go of judging yourself and others and your plans will be easier to make.

Finally: Breaking silence is transformative. So many bad things brew in silence and secrecy – today, you’re getting ready to resist them.