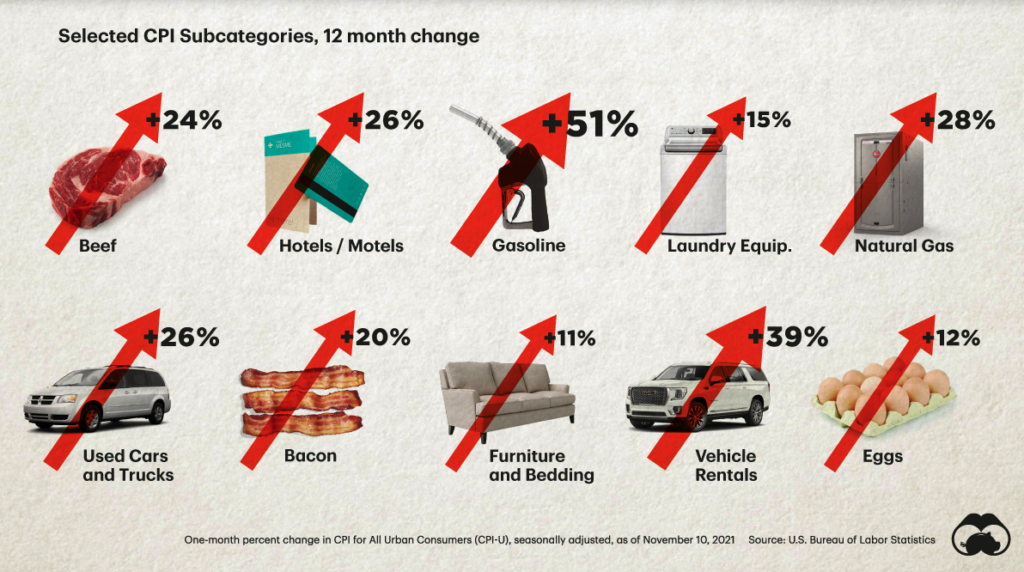

In case you haven’t heard, inflation is currently kicking our asses: 2021 average cost of living was up 6%, , with some areas being increased well above that:

Inflation impacts your budget by increasing the money you have to spend on everything, from food to gas to housing.

How can you deal with inflation?

1 / Invest extra money

[eg money you don’t need in the next year or so] into assets that will appreciate over time to “keep up” with inflation – generally stocks, real estate, and [a little] crypto. If inflation is 6%+, you do not want all your money sitting around in checking or savings or a HYSA earning 0% or 0.5% [again, unless you’re about to use it soon in which case it does make sense to take the loss and have the cash available on hand] You can always consider attending my Money Like You Mean To personal finance workshop if you want to sketch out your plan for your cash on hand.

2 / Rearrange your budget

You are going to be spending more on basics than you used to. Look over the last 3 months of your spend and offer yourself some empathy. Whether you “blew” your budget, or just held your nose and went for it, go back and look at the reality of your cost of living. Turn to your plan for spending and adjust up where you need to, and adjust down where you can, if you need to. This might be the moment for a temporary reduction in savings or other goals until you can increase the money you have to decide around.

Which brings us to your big swing to deal with inflation:

3 / Bring more money in

To cover increases in costs, usually by getting paid more at your job.

3a // If you work for someone else, that means asking for a raise – and ideally, a higher one than you might have gotten otherwise. 3% COLA is not going to cover what’s happening on these streets. Given the increase in salaries for new jobs across many industries, you can do this by switching jobs, getting another offer just to show your current employer your roles’ value, or by talking to your manager/the owner well before your review cycle to let them know about the value you bring AND the value of your role.

3b // If you work for yourself, you’re in charge of giving yourself a raise. Ta-da. The way you’re going to accomplish this is bringing more money into your business, which you can do three ways:

A / cut costs – which will be challenging right now in terms of materials and external labor

B / pivot – change how you make a product/package a service, so it costs you less to do

C / change more for what you sell. This one gives you the most control. It also tends to feel scarier, or more confusing.

I know this because a LOT of you have reached out for coaching about pricing recently. Often, folks need help with:

- Balancing accessibility in prices with sustainability in business [hint: you don’t owe all your clients more than you owe yourself. You have to make enough money to avoid resentment and take breaks so you can keep on. This means at least one part of your business must be something you charge “full price” for]

- Determining how to tell clients or customers prices are going up [hint: beginning of the year is a great time for this, and people are more understanding than ever]

- Deciding which prices are going to change [hint: think about the impact to your bottom line! Which is going to help you more: e.g. instead of ten $5 increases, are there four $100 increases?]

- Figuring out how much money they are making today [hint: it’s called your business model, and you can map it out] …

- And, how to relate today’s money to a higher future income, when today the money isn’t enough [hint: it’s ok to change what isn’t working for you, and to identify new ways to create financial footing. What if you had an income stream that was functional, what income would that be creating, and what would that allow you to do?]

If you’re not bringing in the money you want to, or if you’re struggling to figure out what to charge to be sustainable, I get it — and you can change.

I like to coach people to:

- identify the money you want to make

- add up what you’re currently making

- what’s the difference, in dollars? do the math

- come up with ideas on how you’ll close that gap: raise prices? new services/products? new market/clients?

- make a plan to implement ONE idea. start with the one that’ll make the most impact for you soonest

I really used to suck at bringing in enough money. I really struggled to figure it out, and it made my life harder than it might have had to have been. Yet, once I started experimenting with pricing and business models, I’ve been able to bring in more money consistently, while still doing the work I want to. It has changed my life on every level to have enough money, and to imagine and act on the options from it – and that’s why I put together a course on pricing.

If you want to work on your pricing with me:

- Deep dive and come out with a vision in a live workshop to make your own pricing plan on 1/20/22 for $89 + access the digital course afterwards

- Deep dive on your own schedule in a digital version of the live workshop here ($77)

- Touch on it as one of the seven modules in Money Like You Mean To workshop for freelancers / small business owners ($100-$200 sliding scale)

- Strategize with me and define a business model and experiment in 1:1 private coaching (yes books are open again! $495 and up packages for new clients, folks who’ve taken Money Like You Mean To or coaching in the past are welcome to book follow-up sessions anytime)