To wrap up Ride Free’s Five year anniversary I’m taking you inside my financial journey over the last five years: income, spending, and savings/investing. In this post, details on income and how I split up spending, saving, and investing at the various incomes I’ve made along the way.

SUMMARY

My key strategy has been: know where the money goes, which is why I can spell out these so clearly:

In 2015, after taxes, I spent 65% of my income monthly, gave 5%, and saved/invested 30%.

In 2020, after taxes I spend 42% monthly, give 3%, and save/invest 55%.

THE PERSPECTIVE

The main difference five years ago to today? I make more money – as in 5x more.

- Let’s be honest: more money means it’s easier to save money, that’s why the big difference

- Even though I give less as a percentage, I give way more than I used to be able to. Fun fact: average donation is 3%

- It took four years to make this jump, and another year to start to adjust.

- Listening to my clients without judgement meant I was able to gather evidence about various salaries, consulting rates, and financial experiences, which also helped me a LOT.

I like clients to examine their money by determining the money available to decide with — what’s “yours” after taxes and if you work for yourself, any costs you incur to make the money?

THE STRATEGY

Once you know how much money you’re working with, then you start making a plan with it.

My first strategy has been: save money even when it sucks to, because it could always get worse. Tragic? Yes. Being unable to pay for heat or food? Worse, and I have been there. Savings for me have been THE safety net and feel non-negotiable for a sense of psychological safety.

Given how income experiences are wildly divergent right now and many people who saved are having to empty their accounts to survive without work, it’s a good reminder that “savings” is not enough to guarantee financial resilience. Social and community safety nets are a critical part of this resilience

My second strategy has always been: have all the jobs, because any of them could go away or I could feel over doing them at any time and want to be able to tap out. I never want to depend on one source of income, not after the horrific dayjob experience I had at a certain fancy NYC university and not after living without enough. It’s amazing how scarcity will train you, or at least, how it trained me.

To me Having All The Jobs means some control, though of course, we’re all precarious: financially unless we’re multi-millionaires, socially unless we heal our interconnected safety nets and have strong communities, and environmentally if we don’t globally address climate change. Having All The Jobs isn’t a panacea, and so my strategy has a limit to how much it can do for me which is important to remember, to avoid fake saviordom of individual success.

THE BREAKDOWN

As I said, my main strategy has been: know where the money goes. And unlike a certain president, I’m not afraid to tell you how much I pay in taxes.

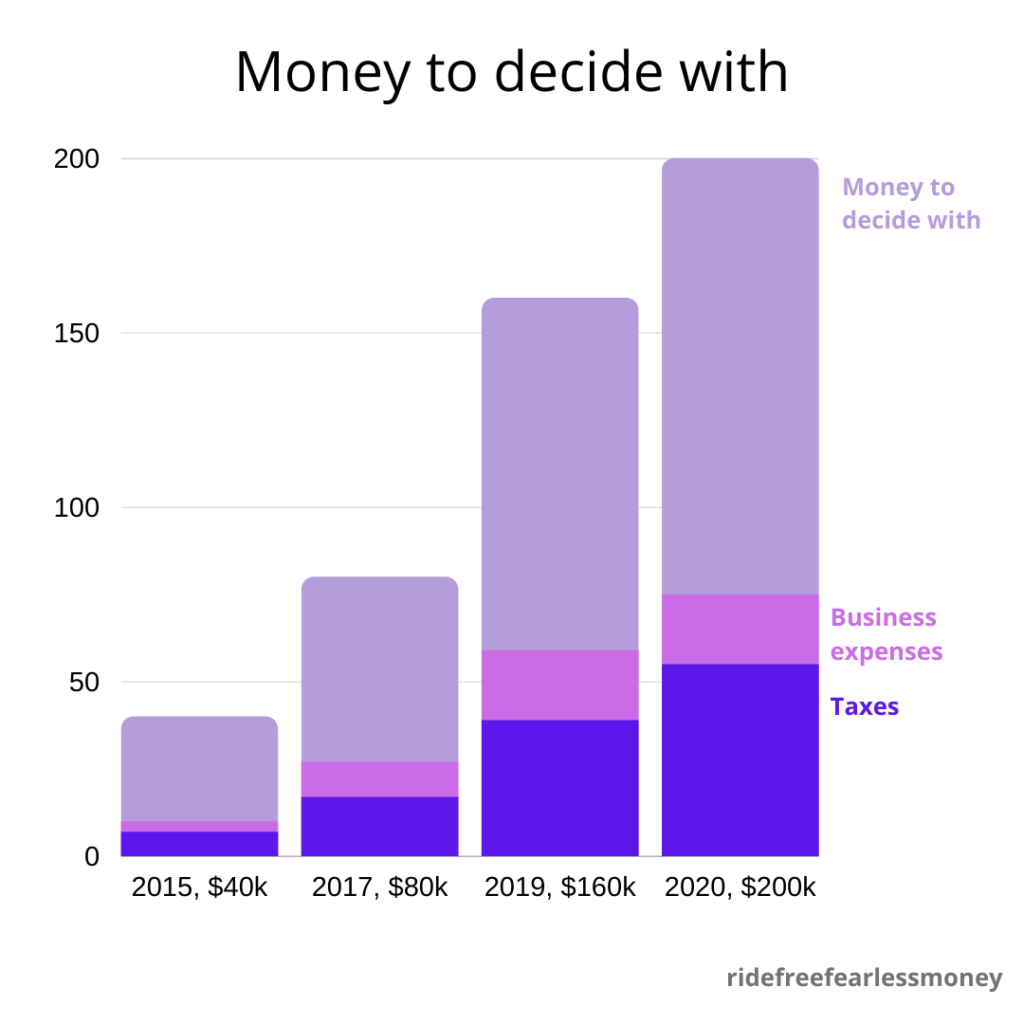

The chart below summarizes the breakdown below, of my after-tax save/spend/invest model and the salaries and side gig money I was making, before business expenses which we all know aren’t nothin’.

*************

Fall 2015, when I decided to start Ride Free: I’m making $36k at a tech coop and another $3-4k from consulting. I paid maybe $7k in taxes.

- Spending: 65%

- Giving: 2%

- Student Loans: 3%

- Saving: 20%

- Investing: 10% – I’d opened a SEP IRA years earlier when I started freelancing, and I also put $ into a Traditional IRA (it all should have been into a ROTH but…ah well)

- Taxes: Can’t find 2015 but in 2014 when I made 34k I paid $2.6 federal + $1k state/city so it seems like doubling that is a safe guess.

2015: The year I realize that my “stretch goal” of making $50k that year is too small to achieve my dreams, and that I will never buy a home in NYC at my income and with no family help. I start to worry, then I start to learn absolutely everything I can about money. I always was committed to saving money, and had some lil retirement accounts going. In 2015, spending the bare minimum I had to, to eat and live, took most of my income.

2017 – I’m making $60k at a nonprofit, about $20k from consulting, and $1k from RE income. I paid $16.9k in taxes

- Spending: 65%, including–

- Student loans: 1.5%

- Giving: 2%

- Dental: 5%

- Saving: 20% – focusing on funds for travel and have a safety net, but stacking into my down payment fund is recurring as well.

- Investing: 15% – work 403b, SEP IRA, ROTH IRA

- Taxes: $11.5 + $5.4 state/city

Ah yes, 2017 the year I started spending mad money to fix my teeth, and feeling grateful for every dentists trip I could pay for after all the years of student dentists. Never again!

2019 – I’m making $125k at a tech job, another $42k from consulting, and $3k from RE income. I paid $39,500 in taxes.

- Spending: 46% – 15% on housing and the rest on living what feels fancy but what I learn is called “middle class”

- Giving: 2%

- Saving: 30% – getting that down payment fund funded like WHOA with 25% of my income going to it, kicking ass throwing money into my emergency fund, and various sinking funds for travel and so forth

- Investing: 24% – 401k retirement at work, SEP IRA from consulting, and starting a few nonretirement brokerage accounts with roboadvisors. No more ROTH, I make too much money.

- Taxes: $25.7k federal + $13.8k state/city.

2018 was the year I decided I was going to stop under-earning on my skill set and go get a $100k+ job even though I had no idea how and it felt extremely uncomfortable and alien. But, I did it. Therefore in 2019 I had a hell of a lot more money. You will not be surprised to learn that...making more money makes it easier to save money!

So, even though my spending % of income went down, the monthly amount I spend each month went up, as I felt I could finally afford haircuts in NYC lol and self-care beyond the basics eg finally went to the chiropractor. Hypothetically, I could have decided to break out onto my own with Ride Free – but I’m so glad I didn’t. I learned so much from the job I took, it was a career game changer and set me up in ways I never would have discovered on my own. This is why, strategically, I am into having jobs: learning AND money AND risk management!

Consulting in 2019 and 2020 popped up dramatically because I started doing more expensive design facilitation for orgs – finally getting my pricing and anchor offering right! Having offerings that let me do good work and backfill paying myself for the other work I also want to do that’s less sustainable otherwise (eg sliding scale)

2020 – I’m making $160k+bonuses at another tech job, $50k from consulting, and $5k in RE income. So far I’ve paid about $52k in taxes with another $10-12ish expected.

- Spending: 43%

- Giving: 3%

- Saving: 33% — 22% to fill up a down payment fund, the rest for various sinking funds for travel, holidays, replacing broken shit, car maintenance, getting a dog etc.

- Investing: 24% – work retirement 401k, SEP IRA for consulting retirement, mom fund in NY muni bonds, opportunity fund and some future-house funds in timed roboadvisor portfolio funds.

I negotiated up my salary at my tech job at the end of 2019, then in Feb 2020 my team got cut and I got laid off – with severance. My mind was blown, and then I invested half the windfall. Two months later, I got a new job at the same salary, absolutely destroying my imposter syndrome and confirming for me that this formerly unbelievable to me income in fact reflects the market value of my labor.

My mom said “what do they have you do, mining gold bullion?” which pretty much sums up how most of the people I know comprehend higher salaries and how I did until I advocated for and got one. I help other highly-paid people make informed decisions, which is a pricey skill due to how much MORE costly indecision and ill-formed decisions are 🙂

With the recent $ bump I started paying for more meaningful stuff for my mom, and saving an oh-shit fund to cover her future needs. My retirement accounts no longer depress me, they give me a shred of hope. I decided I could finally afford therapy. I started paying someone else to clean my house, including paying them for bookings cancelled due to shutdowns. I bought a car and paid for a month of AirBnBs to escape the horrific drama of COVID-19 in NYC. It’s ridiculous that it takes this much money to do these things but for me, since I’m also committed to saving a lot, it did.

****

So there you have it! Five years of growth, learning, and stepping up my earning game.