In order to get myself to finallllyyy finish a Will that I’d been dragging my feet on, I had to sit down and really ask myself to think about the problems I’d create if I didn’t do it.

Not only did that light a fire under my ass, it got me to ask myself why it’s so damn easy to ignore major-yet-boring things like securing our wishes after death, the most guaranteed life event of all.

Why is avoiding or ignoring the biggest stuff so common? And…

What is lost when we ignore money?

In particular, what is the possible personal, professional, or organizational loss when the differences in amounts and impacts of relationships we all have to money are swept under a rug?

Opportunity cost is what you miss out on, lose, or don’t get by NOT doing something.

It’s everything from “Meh, I’ll figure it out later” to “I have time, I’ll get to it” to “That doesn’t affect me so I’ll leave it to someone else” to “I want to do this but I’m not ready / scared / unsure.”

At what opportunity cost is this ignorance bought?

The opportunity cost of not engaging truthfully and meaningfully with money is HUGE across the board.

After working with individuals, small business owners, nonprofits, and corporate teams on budgets and financial engagement plans these last five+ years, I have an informed vantage point. And it’s tragic to watch because this is a solvable problem, if you’re willing to face it head on.

SELF ASSESSMENT

I will give you examples of opportunity costs below, but first here’s a way for you to quickly learn if you’re facing the risk of opportunity passing you by.

As you read through the examples below, consider if they are relevant to you. If so, think about the risks and benefits of each, which you may or may not be exposed to.

If you’re not at risk and have no possible benefits, move on! However if there is relevance, risk and/or reward on the table — consider what you might be missing and get it on your to-plan-for list ASAP if you think the risk or reward is high.

PERSONAL OPPORTUNITY COST

Creating a Will

I recently, finally, finished and signed off a Will. For me, it was a Bucket List by 40 item to address, and considering that I’m six months out, it was time.

The risks for me, and anyone, of not having a Will are simple:

- Many states (including NY where I live) will force a legal proceeding to distribute assets post-death if there is no Will, meaning that my friends and partner wouldn’t be able to say access my savings to bury me or take a month off an grieve if I had no Will. YIKES.

- Since I’m not married, even though I have both romantic and a platonic life partners, the State doesn’t care and would automatically distribute any assets I have to my blood family. ACK — NOT what I want to have happen.

- Finally, I’m not stacked but I’m not broke either and now I’ll have a few Gs going to nonprofits I care a lot about because you can name whoever you want in your Will!!

God forbid a freak accident take me in the next few years, I can die knowing my beloveds:

- Know my medical wishes and needs, and are legally empowered to act on them

- Can access my money if I’m incapacitated so my shit don’t fall apart if I revive, and

- Won’t be fighting with my family

Investing for Retirement

The truth is that time is the game changer with investing, and alot of the risk revolves around shortening your time to participate — and coming up with the money to invest to start with.

Reward

- Looking back over US stock market history, every 10-15 years an investment doubles. So while there’s no guarantees going forward, an informed guess could lead you to believe that your investments will double every 10-15 years, based on math.

- If you get started investing at 25 instead of 40 you’ll have double the money plus extra because compound investing is a money generating machine.

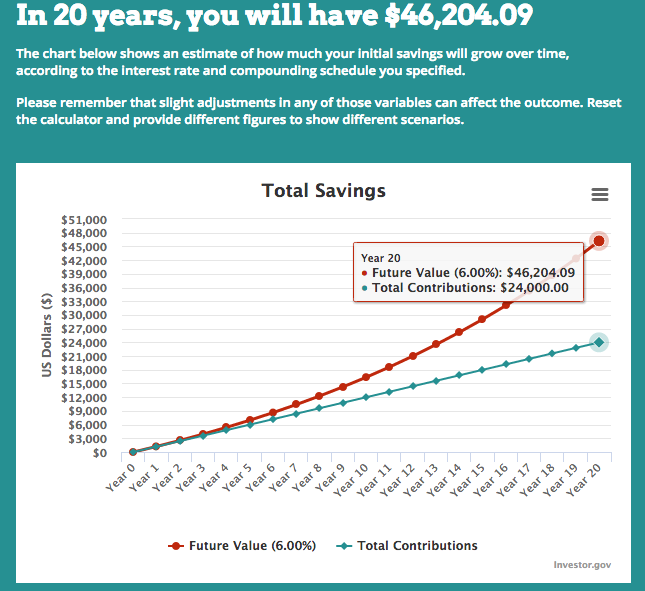

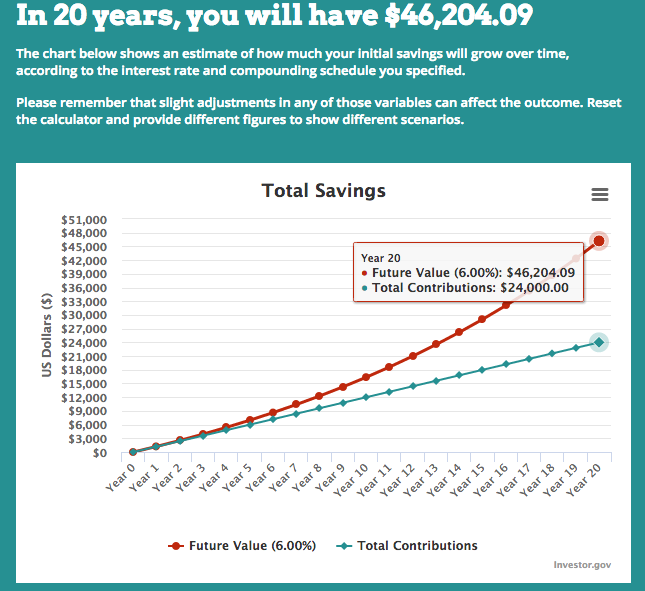

- Look, $100/month thrown into an investing account, earning a modest 6% could turn into $46k in 20 years – not nothin’ and double what you started with so that’s a reward right there!

Risk

- Obviously capitalism or the US Stock market could crumble at any time and there are no guarantees — so that $46k you made could drop to half like it’s 2009 or, hell, almost zero like it’s 1929. I assume that in any of these cases all of society is going to have to solve the problem, and it’s better to risk on the side of having money in case it doesn’t collapse and I need it.

- Finally, you have to come up with the money to invest which isn’t easy when you don’t have a lot of money to start with. At my most tight $28k/year income years I still found $50-80/month to drop into investments. Risk: riding my bike instead of taking taxis.

PROFESSIONAL OPPORTUNITY COST

Raising Your Rates

If you have a side hustle or a consulting/freelance business, what you charge people is a constant source of pondering.

Risks

- if you’re charging too low, you’re leaving money on the table

- But if you charge too high you might lose clients, or only end up with a certain type of client who can afford higher rates

The rewards are in the numbers

- An extra $5/hour or $500 a job can mean thousands of bucks rather quickly

- Plus, charging – and paying – what a service is worth means that others can raise their rates and develop an ecosystem

Going for a new job (and negotiating up!)

This one is a doozy! Getting more money out of your work offers the rewards of:

- Narrowing the gender and race wage gap (depending on who you are)

- Getting paid, paid more, and maybe even HELLA paid

The risks here are minimal since…

- If you negotiate up when job seeking and a workplace retracts and offer you really want to run away from that job anyway

ORGANIZATIONAL OPPORTUNITY COST

Missed engagement for employees of various class backgrounds.

If you’re an employer, you’re aware that retention of great employees is hard – and it’s expensive and disruptive when good people leave.

Risks

- Sorry to have to break the news but your employees who come from poor and working class backgrounds notice the middle class bullshit around them. Whether it’s a coworker who works less hard and gets away with it, or the culture at the workplace – it’s obvious to them even if not to you.

- That kind of disruption can lead to lower performance overall and lowered retention

Honestly, the only rewards I can imagine for not engaging employees and colleagues around money is:

- maintaining the status quo

- keeping people in the dark

- making it seem like people with existing access to money and power should continue to do so because…history or something.

Teams struggle unnecessarily

Regardless of the class makeup of groups and teams, cultural avoidance of money talk or regelating it to abstractions like “value” or “the budget” leads to messes.

I’ve seen risks play out such as:

- many teams full of smart and talented people reduced to a frustrated panic over annual budgeting, based on emotional beliefs about money

- the impacts of imbalanced pay, which absolutely leads to employee retention issues, not to mention possible lawsuits depending on the state you’re operating in.

- the wasted money allocated by employees who operate from spending norms that don’t maximize the organizations’ resources

- Besides the direct waste of time and misallocated money, the emotional and performance drain is far from trivial.

While it’s not easy or instant to solve, processes I’ve been part of that succeed do the following:

- Use transparency, even when it’s hard

- Encourage and reward speaking up

- Allow contribution to budgeting and financials from multiple levels of the team or department

What does it all mean?

These last few weeks I’ve been reflecting on the challenges organizations face around money, financial decisions, and making meaning out of stewarding resources. With a personal budget or solo business, we can pretend we’re operating individualistically (ps. we’re not), but within groups and organizations that fiction gets blown away because we’re working on money with other people. This is where things start to get complex and, in my experience, fascinating. If you’re part of an end of year budgeting process at an organization, watch the emotions and methods people use to make decisions sometime.

If you want to observe power, notice how decisions about money get made. Would you replicate them yourself, and why or why not?

What if we leveraged money as an opportunity to engage more people, answer more important questions with better data, and live more authentically recognizing the truth of our differences?

One thought on “What is lost when we ignore money?”

Comments are closed.