YA TAX DOLLARS

If you haven’t seen Cardi B pointedly ask “Uncle Sam, what are you doing with my money?” then I gotta recommend you take 50 seconds and watch the video. A++++

Done watching? She makes GREAT points – where does our tax money go? Like literally what are you people doing with it? How do I end up paying 40% taxes and why don’t I see the money doing work where I live? (New York *is* gnarly, yall…)

Here’s the thing: I currently spend my days working on a project that helps people answer that question — where does tax money go — and takes it a step further, inviting community members to decide how tax dollars are spent using participatory budgeting. But it took me six months+ of working directly on this topic, every weekday, to begin to understand how tax money and the government works, so it’s REALLY fair that most people just don’t know. It’s not transparent at all!

That’s why I think this next tool is really neat, (and why I spend a lot of professional time working in open data in general) – thanks to technology, a lot of government spending information is out there, but buried in spreadsheets, waiting for nerds like me and my colleagues to have at it and make it legible.

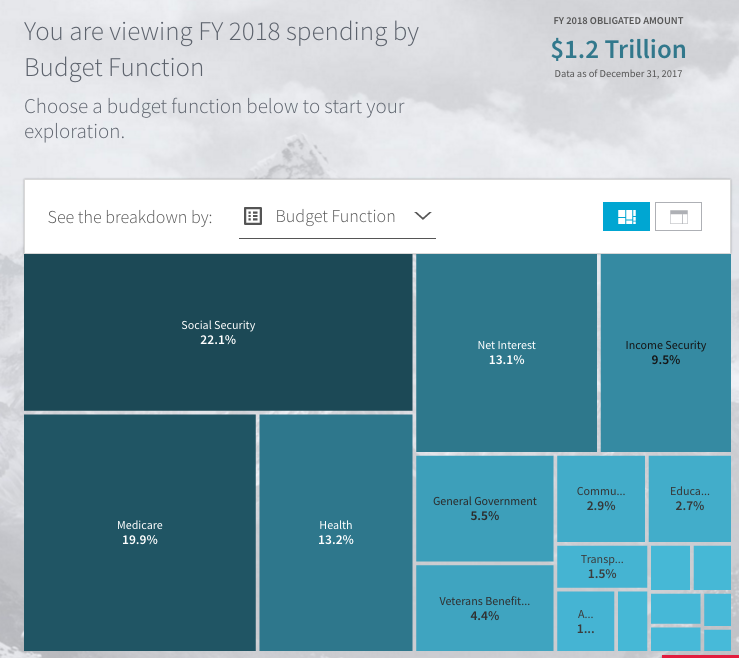

Cardi B, here is where your — and all of our — federal tax money goes, visualized by the friendly nerds over at US Open Data, 18F, and the Treasury Data Lab (thanks, yall):

That’s 2017, friends. Here’s 2018 – so far:

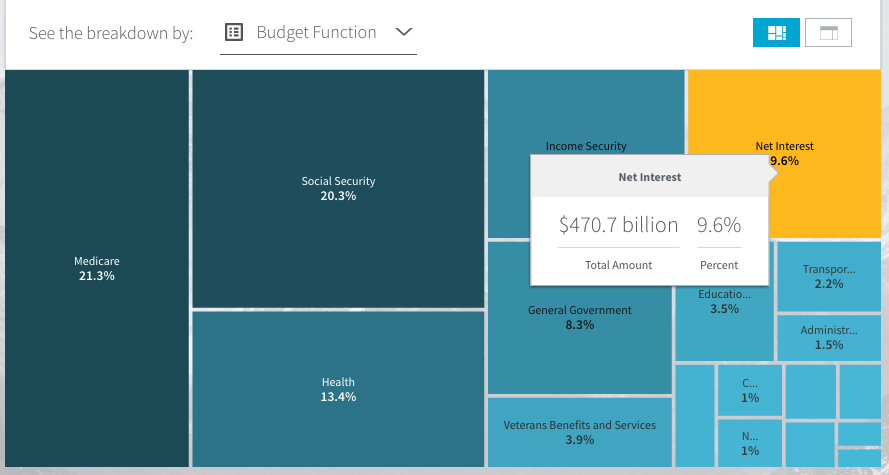

I don’t know about you but something stands out to me here: net interest, 13.1% – what’s that?

Drilling down, that is $150.2 BILLION paying interest on Treasury Debt Securities (US Gov’t bonds, which are what our government sells to get/make money)… so far, in Q1. That is to say – this is just the beginning of the spend.

In 2017, the US Gov’t spent $470.7 Billion total on interest on bonds.

INTEREST on bonds, not like repaying the bonds or any such thing. Which kind of makes 2017’s $183.9 Billion for the Department of Defense seem small (!):

So, Cardi B, where your, and our, tax money goes is about 10% to cover our debt, which seems to be going up but 2018 is still so new, we’ll see where it goes.

The rest is kinda boring but cool stuff like Medicare and Social security – but hey, y’all can check it out for yourselves: https://www.usaspending.gov/#/explorer/budget_function and https://datalab.usaspending.gov/

YA TAX RETURN

As for us regular folks who are dealing in hundreds, if we’re lucky thousands, and if we’re talented and smart like Cardi B, lots of thousands, we’re probably thinking about having paid taxes recently (ouch!) or getting a tax return (yay!)

My take is this: It’s better to owe money in taxes, as long as you have it in a high-interest savings account in the bank and can pay it by the due date, cuz then you’re not giving the government an interest-free loan. Believe me, there is no interest free loan they’re giving out. Plus it probably means you made money, which I want for you.

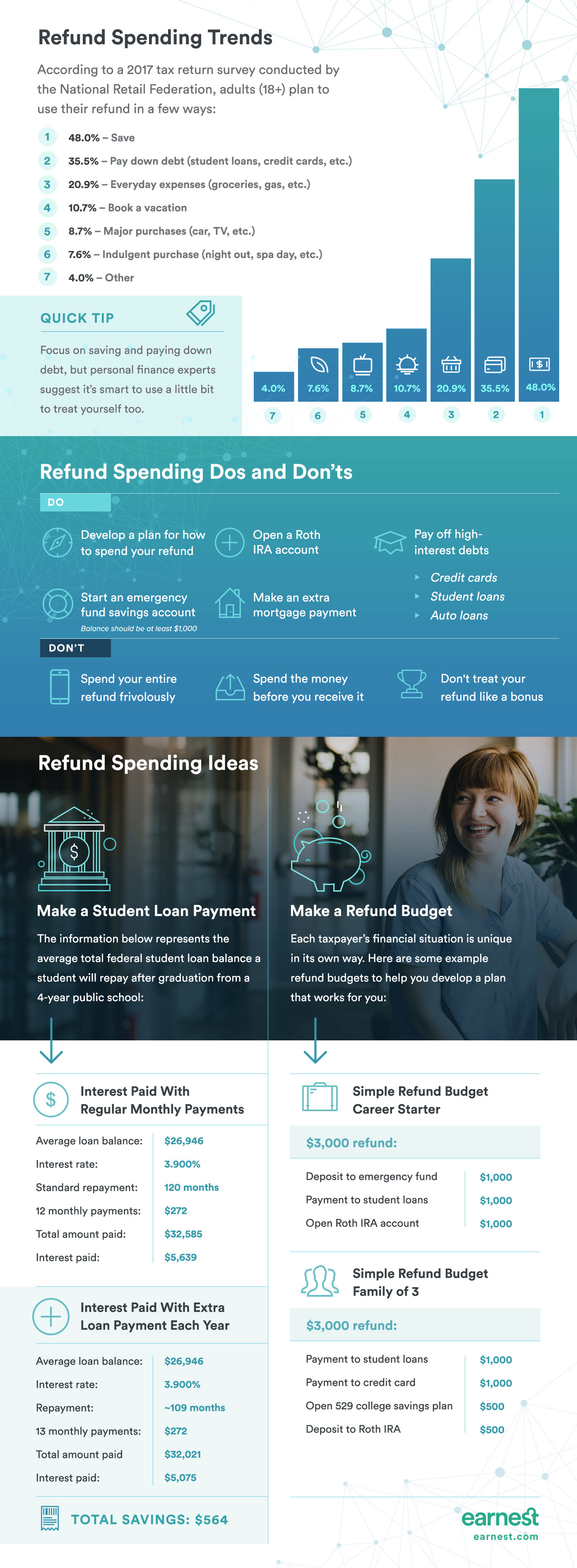

But if you are one of the 7 in 10 taxpayers who DO get a federal tax refund, it’s a GREAT time to be super savvy with that money. The average refund in 2018 is $2,925 according to WalletHub. That’s a chunk of change, dudes! Big chance to be smart and not, as we observe the federal government is doing, have to spend 10% of your money in perpetuity servicing debt – no! Pay some of that shit DOWN.

I like this infographic from the folks over at Earnest, who were kind enough to share it with me to give to you. I am A+ on their ideas of splitting the return into a few big meaningful saving/debt payoff chunks.

I’d add a caveat to give yourself some kind of smaller “bonus” or treat: I usually break off 10% for fun spending when I have an extra lump of money above my regular budgeted income like this. Recently, that meant I got a new bicycle! However, if you’re in debt then it’s fair to think of dumping the whole amount onto debt as a treat – the treat of getting the hell out of debt faster!

Read on for some facts on how others deal with their tax returns and get some solid ideas for how you can allocate yours.

YA FUTURE TAXES

Finally, with the new tax code coming into play this year in 2018, WalletHub released its 2018 Tax Burden by State report and I gotta say it’s looking rough for us in NY as we carry the highest tax burden in the country at 13.04%. (And our city is still covered in trash).

As always: save money for ya taxes, don’t let messing with the IRS get in your way, and if you need to try to estimate your taxes, try my free calculator here!