Let’s Make a Resilient Giving Plan

Ok, you read the last article (and have done your budgeting) so you’ve got a sense of giving context and your money overall, you’re honoring your contributions of all kinds, and you’re ready to take the next step so you donate. Here’s where you go from here:

How might I create or structure my giving plan?

Again, your plan should lay out: how much to give, when you give, and how you give it in order to help you the most.

1. Come up with the amount of money you’ll give, a specific number or percentage

In this section, first we’ll break out giving for folks giving from unearned income (gifted wealth) and then turn to plans for giving from earned income sources.

Giving From Wealth

For some of us, the money you have available to share means giving away money you didn’t have to earn, and which you may not need to survive (e.g. wealth).

If this is you, start by looking at a quarterly or annual investment investment statement to see what your wealth is, and what it is earning in interest. That’s right: know thy money (again!).

You can sit down with your CFP or accountant and come up with a number you feel comfortable shaving off the principal or pulling from earnings only. Here’s two ways that might play out:

- You decide to leave the principal intact so you can earn and give money in perpetuity. Therefore, you plan to give away the interest earned each year (after taxes). A safe estimate here means planning to share around 4-5% or so of the money annually. If you have a million dollar trust account, that means giving away something like:

| Trust amount + | 5% Annual interest earned – | Capital gains tax = | Donation amount annual | Donation amount monthly |

| $1,000,000 + | $50,000 | – $7,500 (15%) = | $42,500 | $3,541 |

2. You decide that you want to give away a certain amount of money. Maybe you don’t want to take it with you and don’t care about legacy wealth, maybe you know more is coming, maybe you see urgent need you are moved to help. You pick a number.

This might look like booking time with your CPA to explore: “How can I spend this down over X years (5? 10? 25?). What projections can we come up with so I can take out from the principal without losing a ton on taxes? Can I make direct stock donations sometimes and avoid taxes so more money delivers to the recipient?”

Giving From Earned Income

For a lot of us, we’re giving away money we had to earn, and which represents us not buying something we may want or need that can’t be funded otherwise.

That’s reality for most people, and it means that any gift you make is coming at the exchange of your labor as valued in capitalism.

As mentioned earlier, to come up with your giving plan, first I recommend that you reverse-engineer your money that’s to be spent or saved meaningfully.

That looks like knowing: (total income) – (how much you *have* to spend monthly to survive) – (long-term needs/goals) = everything left for planned donations and entertainment/consumer spending.

For example someone making $32k/yr bringing in $2,000 a month might make a plan like this:

| $2000 = | $1500 – | $175 – | $300 | $25 |

| after tax income | Rent, loan, health care, food | Savings needs | Consumer spend (travel, clothes, toiletries, going out) | Monthly donations |

If they’re giving $25 this person is giving 5% of the money they have left over after their basic survival is covered, or 7.5% of their “extra”. It also means this person could, if so moved, technically give $300 in a given month, trading off buying ALL consumer items (which is pretty tough in today’s world).

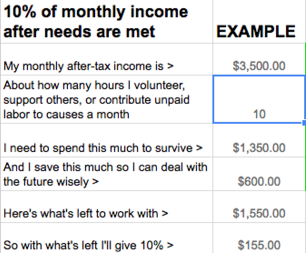

In another example, this person earns about $60k annually and brings home around $3500/month →

After some simple math, they come up with their “extra”, or money left over to work from amount of $1550, and decide to give 10% of that, sharing $155.

It’s worth noticing, that after donating the person giving $25, or 7.5%, has $275 left a month for everything else, while the person giving $155, or 10%, has $1345. That’s a big, material difference in resources available.

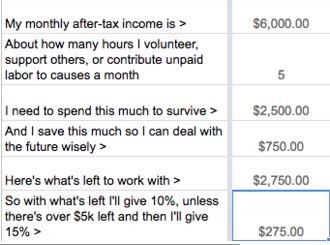

In a final example, this person earns about $120k annually and brings home around $6000/month →

They come up with their money leftover to work from amount of $2750, and decide to give 10% of that, sharing $275.

2) Decide how you’ll allocate or split your donation / give amount

Whether you’re giving from wealth or earned income, this is where giving gets personal, and there’s no wrong way to do this! It’s important to remember that there will always be more worthwhile things to give money to than money available. Your smart tactic? Set up your plan — so you’re prepared to execute it and share what you DO have, when you can.

Sample Giving Split 1: By specific percent or $amount → Pre-define what you’ll share

Our $25/month donor might think about this:

| 50% | 25% | 25% | |

| Sustainerships | Online one-off donations | Giving money in person | |

| $25 = | $10 | $10 | $5 |

| *I’m signing up for a monthly donation to ______ today | *This is what I can give once a month to asks. | *I commit to rounding up at one pay-what-you-can event |

This example may choose: One kickstarter or two smaller sustainerships a month + a roundup.

Our $155/month donor might think about this:

| 60% | 20% | 20% | |

| Sustainerships | Online one-off donations | Put in the “big give” account | |

| $155 = | $90 | $35 | $30 |

| *I’m signing up for ___ monthly donation(s) to ______ today | *This is what I can give once a month to asks. | *I commit to saving this monthly and making a larger give annually. |

This could look like a few, larger sustainership donations, chipping in online, and an annual $$.

Our $275/month donor might think about this:

| 70% | 25% | 5% | |

| Direct support | Online donations | Giving money in person | |

| $275 = | $150 | $100 | $25 |

| *I’m giving directly to a friend who’s struggling so they have groceries. | *This is what I can give monthly to asks. | *I commit to keeping this in my wallet and handing it out. |

This could look like direct help for material needs for a family member or friend + more spread-out support for broader calls for money.

Sample Split 2: By Issue Area that Matters to You

This method still requires that you set a $$ you’ll share first, but instead of pre-setting your plan, you prioritize gives by the needs they address, and doling out from your amount as time goes along. I think it’s a little harder but it can work!

Pro tip: Creating a separate account for the money will make it easier to track as you go.

This plan:

– takes a bit more executive function each month, but

+ allows you to respond in real time to needs.

– also means you’ll need to keep track somewhere of your monthly give amount. This isn’t hard, you just have to do it — to make sure you’re actually giving all of what you plan to.

Tactic: you decide your order of operations based on things you care about.

For example:

- Each month I’ll first give to: Black Lives Matter, Black Liberation, BYP100 or an org or person doing racial justice work

- With what’s left, I’ll then give to LGBTQ direct support orgs or causes

- If there’s $$ still left, I’ll then give to whatever health needs crowdsource is going around.

- If there’s $$ still left, I’ll then give to community art projects

Our $25/month planner might think about it like this:

- Ah, I see a bail fund request so I’m putting in $15

- Next there’s a LGBTQ fundraiser, here’s $10

- Oh dang, my friend is sick, I’ll hit them up next month unless I think I can spend a little less on going out this month and make it work.

Our $155/month planner might think about it like this:

- Ah, I see a bail fund request so I’m putting in $60

- Next there’s a LGBTQ fundraiser, here’s $50

- Oh dang, my friend is sick, here’s $30

- Hey a chapbook an artist is making $15 donation for it? Done.

Our $275/month planner might think about it like this:

- Ah, I see a bail fund request so I’m putting in $100

- Next there’s a LGBTQ fundraiser, here’s $100

- Oh dang, my friend is sick, here’s $75

- Hey a chapbook an artist is making $15 donation for it? Fuck going lunch out tomorrow, I’m throwing in.

Sample plan 3: By time — annual

You could also save your give money over several months and wait on a larger need to arise, and then mic drop a bigger chunk of cash.

Our $25/mo example friend would have $300 after a year to help out, our $155 friend would have $1860, and our $275 friend would have about $3,300.

Pro tip: Put aside the money in an automatic savings plan and let the account fill until you see a need you want to address.

This could be a way to go ahead and pay someone’s rent once a year, or buy someone a new bike or get a big car repair done for them. These big drops can have a big impact – that might be how you want to give. It’s all good!

Your job will then be remembering TO give, which brings us to….

3) Decide when to give

Recurrent: Monthly, Quarterly, Annually

Setting up recurring monthly donations online is an easy way to ensure you give money regularly.

Being part of a giving circle where people get together quarterly to decide together to give is also smart (and social) way to get your give into a regular rotation.

As needed

This looks like knowing you’re most comfortable giving money when need arises, often in a community you’re connected to. Passing the hat, crowdsourced fundraising and other random asks all fit in here. Often when we have pretty limited resources, this is where most of our giving ends up happening. All good! If you’re planning on it happening like this, you’re setting yourself up well.

Having an annual plan for when end of year campaigns come through can also help the overwhelm that can accompany the large volumes of asks that mark December.

This might look like just sticking to a monthly planned amount, or deciding there’s an extra amount you want to share come year-end. Generally year-end giving asks come out of knowing that people with larger amounts of resources are motivated to maximize tax savings before year’s end. You could leverage the reminders shared this time of year to sign up for monthly sustainerships, you could use them as a reminder to make your giving plan, and you can donate if you have the $$.

4) Add in some accounting for the non-money things you give: time, food & support!

In respect to the current conversations about emotional labor (check out this article by Leah Lakshmi Piepzna-Samarasinha to get a great overview: https://www.bitchmedia.org/article/modest-proposal-fair-trade-emotional-labor-economy/centered-disabled-femme-color-working), and in respect to the idea that all work is real work — well, it is. Unpaid work is still work — and if you’re spending so much time volunteering for causes that you’re not earning money to give financially, it’s not a huge stretch to suggest that your time is valuable to the work, now is it?

Honoring Your Time: While you’re pausing to assess how and what you give is a great moment to start thinking about your time as a resource that you give.

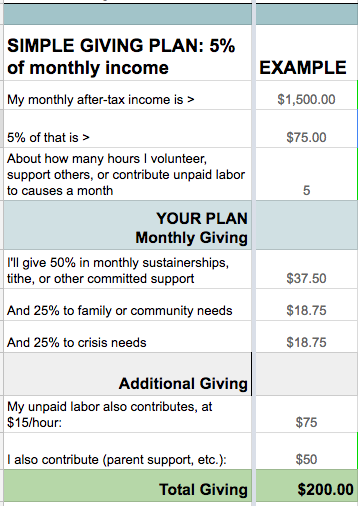

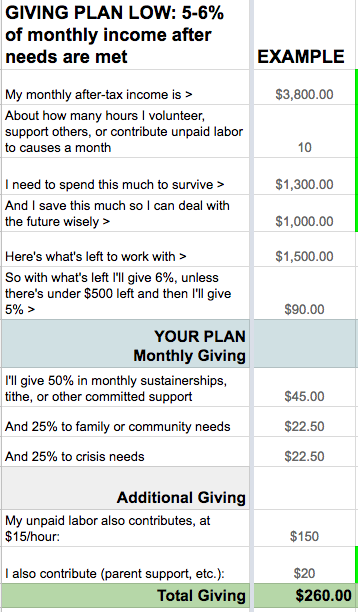

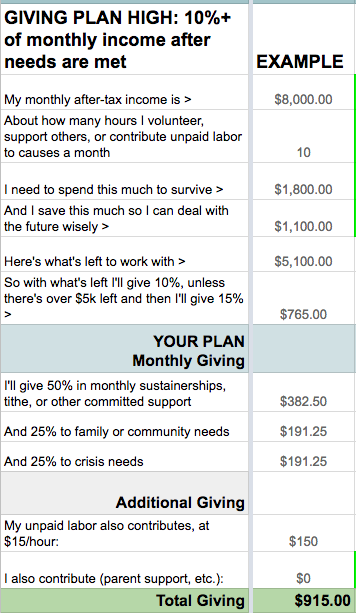

So, in the calculator I made, I included Additional Giving, where you can calculate your “hourly wage” at the current #FightFor15 wage. In the example of someone who volunteers 10 hours a month, donates $90 monthly, and throws in $20 to a family fund, this is what their plan looks like:

Let’s look at a bunch of giving plans, now!

Example Giving Plans

All the way at the end of this section you can grab a link to a calculator & worksheets that you can use to set up your own plan. 🙂 Bur first: real life examples!

EXAMPLE 1

$35 + If you have a small amount of financial resources and a modest giving plan

Money to a church or community group → $20/mo

Might be $5 a week at an event or a $20 thrown in

- Need-based giving → $15/mo

Might look like buying dinner or gas for a car.

- Time spent → 1-10 hours

Meetings are not short! If you go to one meeting a week that’s at least 2 hours, and if you’re on the phone a few times a month, well there’s 10 hours.

EXAMPLE 2 →

$75 + If you have a small amount of financial resources and a generous giving plan →

This person makes $18k a year but gives away $40 a month to church, and $15-20 a month to community needs and crisis needs.

Additionally, their volunteer work and the other $50 they send home means in total they give at least $200/month. That’s generous, y’all!

EXAMPLE 3

$40 + If you have a small amount of financial resources and a modest giving plan

Gotten to by giving 1% of pre-tax income (this is what I did when I made $35k)

All Need-giving → $30-$50/mo

Expressed in various crowdsource and online giving campaigns.

My commitment was $30, and sometimes I threw in $50 total if my grocery bill was lower the month before (that’s a reallocation, folks). I had student loans to nail. Also I volunteered like 30 hours/month.

EXAMPLE 4

$80 + If you don’t have lots of resources but you know you aren’t broke

Truth in advertising: this is my current plan. I “empty” this bucket each month and I start over in the next month. This is my timing indicator.

Sustainerships → $50/mo

Expressed as 2x$10 and 2x$15 monthly donations to BYP100, Third Wave Fund, IDA & Interference Archive, all places I have a personal connection to.

Need-based giving → $30/mo

Usually expressed in a $20 to a needs campaign and a $10 kickstarter.

Time spent → 4-15 hours

I donate a ton of time to community art, because I believe we need roses with our bread. I also spend a fair amount of unpaid time sharing tips on where to distribute resources to those who might not know. 😉

EXAMPLE 5 →

$90 + If you don’t have lots of resources but you know you aren’t broke →

In this example, the person gives $90 spread out over some sustainerships, to community and crisis asks and also gives $20/mo pay for something for a family member.

EXAMPLE 6

$100+ If you don’t have lots of resources but you know you aren’t broke

You could just stash $100/mo into a giving account and distribute it a few times a year when there’s major crisis.

Pro tip: there are a lot of crises, so set your bar. I’d imagine a hurricane that wipes out an island’s power grid or flattens part of a city is a good example of a big crisis… #climatechange

EXAMPLE 7

$~1,800/mo + If you have more resources (and are famous for writing about class)

This is from Dean Spade’s writing on their donations, and the number they arrived at by redistributing massively from a $120k/yr salary. (check out Dean Spade’s article explaining this give here: http://www.enoughenough.org/2009/04/the-dirty-details-of-my-new-salary/)

- Monthly Donations, prioritizing issue areas – $1500

- Community Requests – $200 (?)

- Prisoner Correspondence – $100

- Cash to folks who ask on the street – $50

EXAMPLE 8 →

$915/mo + If you have more resources

In this example, this person has over $5,000 left each month after tax, after TCB and so they give 15% of what’s left (which ends up being about 10% of their income). They give $382 in sustainerships. Dudes that’s $4,500/year. SWEET. If like 12 of you did that? That’s a salary.

EXAMPLE 9

$853/mo + If you have more resources

This is an example from Lukas Blakk’s blog post on their plan to give away 10% of their money (check it out here: http://lukasblakk.com/lets-talk-about-giving-away-money/)

In Closing

Every resource bucket is finite. None of us can address every need, not even every urgent need. Not even if we’re Buffets or Rockefellers or Gates. Only a deep change to our economic system will address the needs across our world.

Because giving connects us further, we should give where we’re connected to. If we’re willing to be woo and think of money as energy (which it is, among other things) then we’re passing it along here. If we’re wanting to be revolutionary (why not?), then we may be funding people and work that are otherwise un- and under-funded, perhaps even “unfundable” (eg unprofitable, things that aren’t tax writeoffs, or things that actively turn down economic growth).

If you’re a person with some excess resources who struggles to give money, you’re not alone – this is complex. And, I’m going to challenge you to make a giving plan in order to make donating use less executive function and be easier. Cut to the sweet part: helping the hell out.

On the other side of the tracks, if you’re a person who gives money which means you end up stretching thin, you’re part of a solid collective tradition of mutual social aid. If you make it work sometimes, then all good: crucially needed money went where it helped. And, if you’re not going to the dentist or can’t pay rent because you gave, I want to let you know that it’s ok and important when the oxygen mask goes on ourselves first.

Finally, a big THANK YOU to Leah Lakshmi Piepzna-Samarasinha for her comments on the draft regarding including emotional labor in our giving, and to Ariel Speedwagon for the term “Giving Gap” and donor research support.

Loving it and want more?

Get the whole chapter + giving plan worksheets & calculator here:

Donations are a major way we support and resource the movements that matter to us. Are you donating as much and as often as you intend to? Are you donating the right amount for you?

In this 20-page guide, learn exactly how to:

- Decide how much money is right for you to donate

- Create a giving plan for your time AND your money

- Understand your giving in context with other people's giving habits

- Make sure you are aware of the giving gap - and plan accordingly

Don't wonder IF you're "donating right" -- learn how to decide exactly what is right for you, and make an action plan you can follow today!

Support the orgs you love and change you want to see, sustainably for you. Download this digital guide and start now.

One thought on “Resilient Donations: Your Giving Plan & Donor Examples”

Comments are closed.