“You don’t want to be rich – you want to be free. There’s a difference.”

What if money wasn’t the thing making problems in your life?

{to be clear, for most of us, money is a thing genuinely making problems)

But what if it wasn’t?

Yes, like an heiress.

Or like someone with a trust fund.

But also, like someone who makes their own money bucket.

First you might think: YAY NO PROBLEMS! But … well …

1 / welcome to the human condition there are problems that money can’t solve my friends, and

2 / there are problems in the world that aren’t yours, which money would also help.

Second, you might think: THIS IS NEVER GONNA BE A THING. MONEY WILL ALWAYS BE A PROBLEM AND I WILL NEVER BE FREE

To which I’d like to introduce you to the ideas of financial freedom & financial independence.

I like to think these as:

- Financial freedom = how you think

- Financial independence = what’s in the bank

People going for financial independence are interested in creating personal financial conditions where money isn’t the thing that forces all their other decisions.

People going for financial freedom want to be free – Like open source free. Like Rastafari free. Like american mythology free. [And yes, we’ll come back and trouble this notion in a bit].

You can be financially free, without being financially independent.

Read that again.

You can act in ways where money isn’t the thing that forces all your decisions, before you have a heiress-sized bucket of money.

I lived my touring life riding that current of freedom: no one was gonna fund my art so I just squeezed it into the world. That had repercussions because I am the heiress of diddlysquat and I found myself needing to hustle to fill in some financial gaps,

BUT it also means I’ll always be certain: there’s choices we can make to de-center money, even when we still need to acquire it in order to survive.

One of the main ways capitalism functions is by its self-centering nature. Putting money at the middle of everything instead of relationships, desire, needs, other resource priorities, etc.

You don’t want to be rich — you want to be free.

The harder part is going to be what you find yourself doing and wanting to do and hustle for once you’re free. What do you value enough to center? What are you about, that’s isn’t your paper? And – are you still connected to it after getting the bag?

Practicing non-money moves TODAY is the cure to the sickness of these questions.

Getting yourself to experience financial freedom at various moments as you go is important. Ask yourself:

How can you be financially free for a day a week?

Every morning?

For a month this year?

Because financial freedom is two things:

1. a trial run for the next step: financial independence. The moment when money is a factor, but not a driver in your life.

2. the actual goal. financial “independence” is only a goal because we must have money to live. if it wasn’t required, we could all just stop at the “free” step.

Getting financially independent is my next goal.

Yes, literally having enough money so that I can permanently decenter money from my motivations is my goal.

Financial independence, aka FI/RE has a radical history (even if today it’s 80% white guy engineers who make spreadsheets and stress out about savings optimization rates) starting with the very cool eco-feminist Vicki Robin who simply thought “if we consume less, we’ll spend less AND destroy the planet less— so how might we encourage people to consume less?” And kickstarted a movement. Her book, Your Money or Your Life is a game changer and was re-released in 2021. I highly recommend it, or just find a podcast Vicki is on and listen.

Financial independence can look a lot of ways:

- Having investments that grow to a value such that you can sell them very slowly or get dividends from and live on that money

- Having a combination of investments and other assets that produce income, like royalties, sales, or rental income

People have crafted all kinds of Financial independence (FI) variations, like Coast FI – eg you’ve invested enough in retirement early in life and now you can “coast” through the rest of your working life.

LeanFI – cover basic expenses if you like live in a tiny house.

BaristaFI – invest enough to cover some of your expenses and then plan to work a low-stress part-time job

A lot of FI also hinges on:

- Crafting an inexpensive life, such that you need less income from all the above ^ to make them more accessible, and

- Increasing your income at points along the way and using the increase to acquire assets or/or to create things that produce income

FI isn’t an end state – it could be a trap within a trap

Financial independence as we see it today is also a function of the over-indexing on independence our society creates.

Saving a lot of money is going to be hard. But I have learned to increase my income, do super high-value work, and to move more money my way.

But, because of how much I had to focus to do all that — the harder part of financial independence is what I might find myself wanting to do and hustle for after. The struggle starts “once you’re free” because freedom has been in the distance, not a practice.

I call this out so we can practice freedom from the mental crush of capitalism even as we are digging out from it.

I am interested in the experience of financial independence – the freedom AND the bag — because I am a strategic person trapped in the matrix of America at the precipice in 2023.

I am also really curious how to create FI in the context of believing there is no worthwhile or sustainable solo / highlander existence. I understand that my sustainability is also tied to having community and people around me, and meaningful place relationships. I want to contribute to others’ sustainability because it is tied to my own. We are independent in an interdependent way.

I want to center FI in my plans so I remember to do the money things AND so that I come up with and then practice all the ways that I want to be that are outside of money. Since I follow thru on my plans, I will be making this happen so that my 50s have ease and choice.

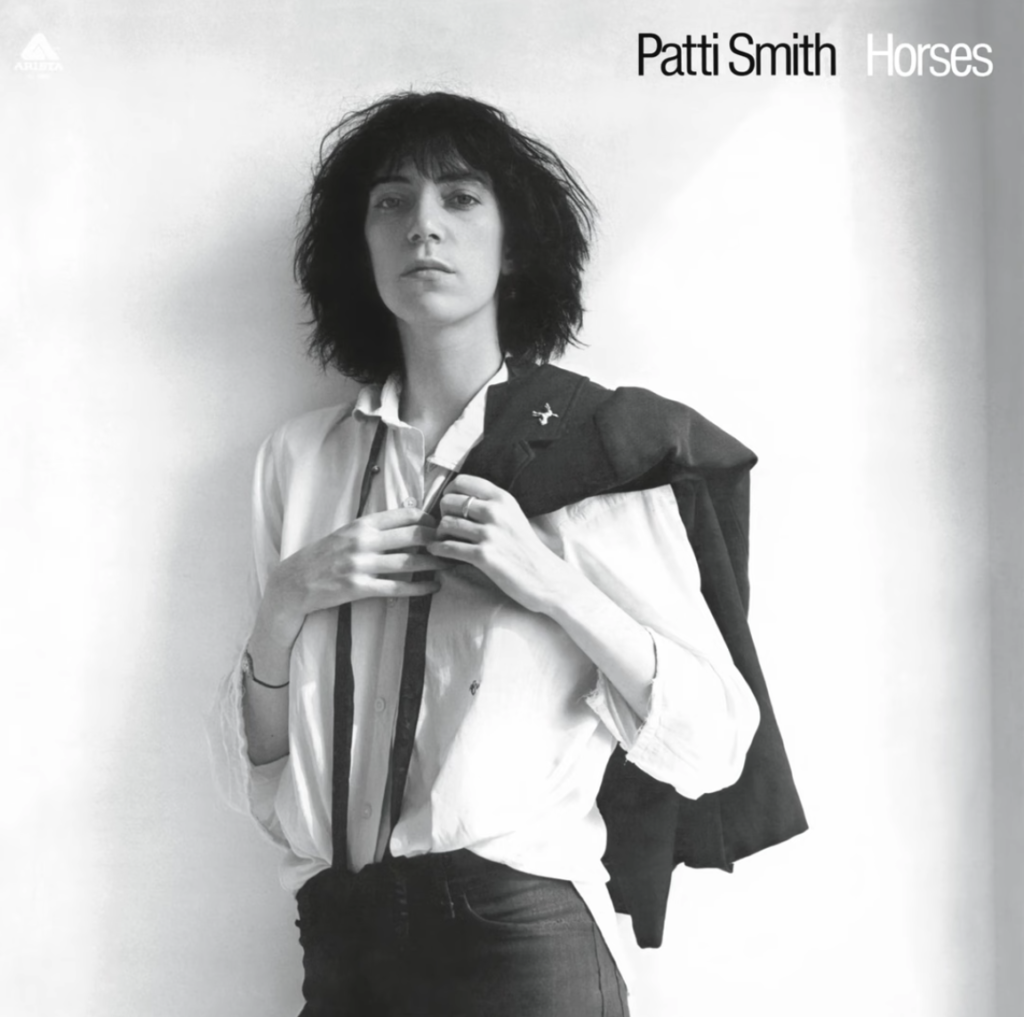

If you want to catch the energy of financial freedom, Patti Smith’s Free Money is one song that delivers.