Recently there’s been a series of articles about millennial burnout, and how it’s related to the endless work that our* generation feels compelled to do to manage debt / stay above water financially / participate in the “freedom” of a freelance economy / try to live the dream and like vacation occasionally.

My favorite of these was by Tiana Clark, where in “This is What Black Burnout Feels Like” she writes about feeling bedraggled and asks if the new-ish hype around burnout is “because white, upper-middle-class millennials aren’t accustomed to being tired all the time?” Work, constantly and without respite, has always been normal for a large segment of people. It’s not new — but it’s still a problem, and it seems to be growing.

I think a lot of you may also be in the “tired all the time” camp, where Clark suggests that many folks who experience marginalization end up. The following ideas are for you, as well as for anyone who wants to improve your work vs time vs outcome vs life energy ratios.

Your hustle might be worth it, but at what cost are you making it happen? How can you tell if you’re getting the outcomes you want or just digging deeper into stress and burnout?

Because burnout and exhaustion sucks, here’s four key questions – and things you can do to answer them – to point your economic ship towards calmer waters.

- How does the work feel in my body?

- Do my systems help me make less decisions?

- What is my actual hourly rate and am I ok with it?

- Can I track what I’m learning and changing?

These strategies are meant to route you around burnout, and I hope they give you tools to assess what you’re doing so that you can make changes if needed. At the beginning of the year, this is the time!

First: kill the grind and go for flow

Key question: How does the work feel in my body?

I have a check-in for myself: “is this a hustle or a grind?” Hustle is fine, it still might lead to burnout but hustles also have creativity, joy, contribution … soul to them.

Grinds are when you are trapped in work quicksand and feel like you’ll never be free. In my experience, crappy or bad fit jobs grind, and they are a fast track to burnout. Grinds are a red flag urging you to escape if at all possible.

The opposite of grind is flow. Flow is where time passes while you do something and you feel all happy and focused and engaged. It’s in your body and of your brilliance. We love flow. I turn off my phone multiple times a day so I can try to get shit done in flow (sorry about the texts).

Ideally, your life, and specifically your work gets you closer to flow. But, make sure it’s sustainable. So…

Next, if you’re gonna hustle, hustle smart

How do you know if the time you’re putting in to your hustle is going to lead to unsustainability and mental overload? Here’s three ways you can quickly assess if what you’re doing is financially going to lift you up or drag you into more work.

1. Chart your systems so you have clear and pre-made decisions.

Key question: Do my systems help me make less decisions?

Nothing says “burnout” like the inability to make decisions – so pre-make decisions for yourself. Later all you have to do is follow your plan, not decide the plan over and over. This saves your precious mental energy!

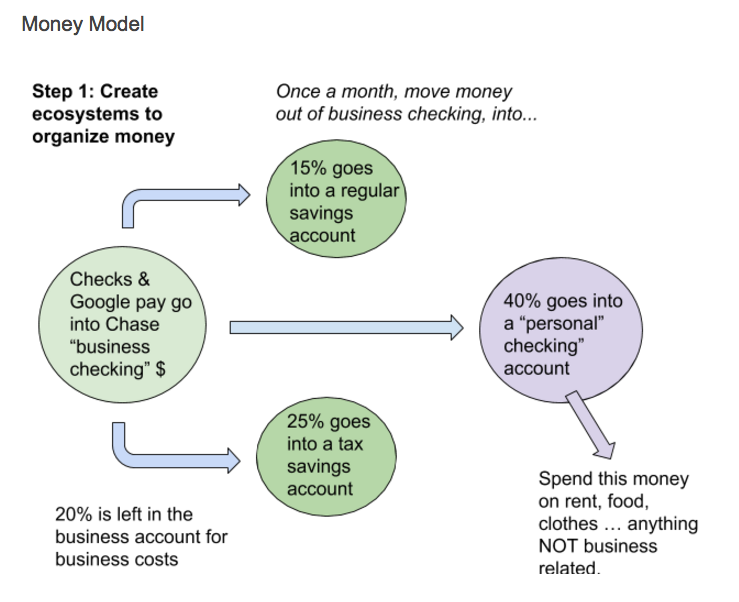

This is *especially* applicable to systems you can automate or set simple rules for, like cash flow. See if you can write out your money system: When and how do you get money and where does it go once you get it?

Writing out your system will make you identify places your system needs a decision – how much into a savings account? How much and where do I put my taxes savings? Should all my money be in one account (hint: if you work for yourself – no!)?

Here’s an example from a self-employed therapist I worked with recently that we made together:

What this person can now do is move 15, 25 and 40% of her revenue into various accounts once a week or once a month in order to simplify. No thinking needed.

Your system chart might include things like:

- What you do with extra gig or side hustle income

- When and how much money you’ll put into an IRA, savings account, or donate

- When you’ll move money from one account to another

Ideally, hand write or draw this out and keep it simple – the easier the better!

2. Compare the money a hustle brings in against ALL the hours it takes.

Key question: What is my actual hourly rate and am I ok with it?

NYS just passed laws making the city minimum wage $15/hour. What if you set a personal minimum wage and an ideal “hourly wage” and made sure your time was earning you, oh say, at least $15/hour?

To do that, as someone with a salary or hourly job: This idea comes from the excellent book Your Money or Your Life. Think of all the hours you spend for your work: at work of course, but also commuting, meal prepping, worrying about work in off-work hours. What’s your TOTAL time? Now, divide that by your income from work. Either pre-tax including any insurance and retirement money, or post-tax will give you information.

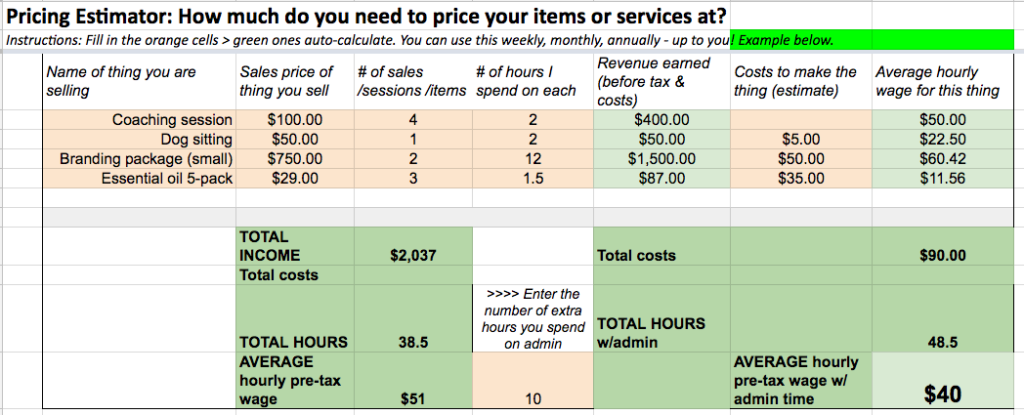

To do this as someone with a side hustle or self-employed freelance work: first you’ll need to know the revenue, costs, and hours spent so you can calculate your actual wage. An estimate is fine here, though if you have exact numbers use them.

For example, the first year of my tour, we realized we made $0.10/hour, once we calculated all the hours of booking and touring in with the after-cost income. Yikes. Eventually, we got to $5/hr (which is pretty good for small-time art in the US). When Ride Free started I was making $8-10/hr, and now it’s $30-40 on average (thank you sliding scale!).

To get these numbers? I account for EVERY hour – not just billable/client/on stage ones. The hours writing, admin, working, learning … every hour. And, I track revenue after material costs.

This person’s average hourly wage is $40, so after taxes and stuff it’s probably closer to $28-30. Now, they can assess if, for example, creating essential oils is something they want to do, or if they want to charge more for dog sitting etc. Information is power!

Create your own tracking sheet, or get the template in the Freelancer Finances training – this link will save you $19!.

3. Track your learning and progress regularly.

Key question: Can I track what I’m learning and changing?

I currently work with startups and entrepreneurs to design systems that have never existed before. It’s tricky, because you can go off track and waste time – but if you get it right, you end up relatively certain that you’re creating something of value.

You, my innovator and creative dears, can use the same strategies these folks do. The idea is to keep track of your learning and changes to your ideas so that you 1) see your progress and 2) can affirm it’s solving the right problems or change course.

It’s relatively simple – you write your idea AND your reasoning of why this idea is solid. Go work on it, come back in 2ish weeks, write down what happened, and then revise both your idea and your why from what you’ve learned. Write it literally above the old idea, and include the date. Rinse and repeat.

If you want to learn more about the practice of hypothesis tracking check out any of these articles or google “lean startup.”

For me, I struggle to imagine stability via any singular job or career in the current economy. So, I hedge by having a few income sources. I’ve always had 2-3 jobs/hustles/projects at a time and balance is H-A-R-D. I am getting more balanced thanks to some of these strategies above and literally just saying No more. As someone who’s hit the wall of burnout in the past, I am NOT trying to go back there, ya know?!

Don’t let those instagram ladies mess with your head: Getting a fabulous (or any) career, trying to run a small business, or stewarding a project is L-A-B-O-R and it takes time and energy.

Burnout might not be avoidable in this economy for some of us – BUT these four methods can help you know if you’re barrelling towards it or easing back from it in terms of your time and money.

Here’s to your year being easier – and your time spent being easier on you!

*Apparently I’m technically an X-ennial being from 1979 and all