… Thoughts on Recent Market Volatility

I’m going to tell you more about how stock markets work, so you’ll understand why drops happen — and what they indicate about capitalism.

Last week was a bumpy ride in the world of people with invested money, and looks like this week too. If you have money invested anywhere – in a retirement account at work, in a personal, ROTH or SEP IRA, in a brokerage investment – you’ve probably received an email with a title like this:

Thoughts on current changes in the stock market

Our observations on recent market events

Our perspective on this week’s market volatility

The email was certainly rather milquetoast and went a little something like:

“We’re writing with our thoughts on recent market events. Our advice is for long-term investors, and it is: that the drop doesn’t matter. Stay invested [maybe insert infographic here]. Stick to your plan/goals/Call us if needed.”

Thanks, guys.

Thing is, there’s not much else they can say.

Why?

- There isn’t going to be a clear reason (the indicators are a little depressing though, as we’ll see below). The stock market behaves erratically, and isn’t tied directly to “the economy” – it is it’s own beast, with an internal chaos logic that we’ll dig into in a sec.

- They’re right about the hold and chill advice, at least according to math and historical stock market activity: the best thing for a long term (5 years+) investor to do is to stay invested. Especially if you’re following the popular “index fund and chill” strategy.

However, we humans being story-driven, a “just chill” email doesn’t answer questions, leaving a blank hole in the narrative: We want to know why!? What the hell is going on?

I’m going to tell you more about how the market works, and then you’ll understand more about why stock market drops happen, are normal — and are indicators of the bleakness of capitalism.

ABOUT THE STOCK MARKET…

The thing you need to remember is: the stock market is itself a collective fiction, based on enough people agreeing on what will make money in the future. It’s a big auction house, and just like in the antiques/vintage market, it’s a little up to whim what blows up.

(Remember Pound Puppies?!)

There’s also no way to know when what’s considered valuable is going to change, or when the overall turn of the market is going to decline or go back up. If anyone could really know this, everyone would be legendary investor Warren Buffet, and we wouldn’t be obliged to put the word legendary before his name. And even that guy picks stocks to hold long-term on a complex analysis that’s not always right.

So, what happened? Chronologically, on Feb 2 the Federal Reserve released a recurring report, noting low unemployment, the strongest increase in wages (2.9%) in a decade and, to some, indications of an increase in inflation. (More money means more spending, means companies jacking up prices, which means not actually having more value in your money.)

Then, the stock market tanked, dropping about 9% over a few days after a wild two-year run only upwards.

Many analysts saw a correlation between the drop and “investor fears” of higher wages, too much growth, and inflation.

The sick part is this: investments may have dropped because workers appear to be getting paid more (which workers, and if their money goes far enough are different questions), in a more competitive market for employers. If workers expect higher wages and there is competition for their labor, then companies will have to pay more to get workers, thus the investor fear … is that this will drive down profit lines. For an in-depth understanding of how investor fears are tracked and anticipated, this article at Schwab explains volatility indexes, sentiment, and their analysis of expectations for further corrections (e.g. drops).

If that’s the big scare – then it starts to be clearer why the stock market is not an indicator of the economy per se. In the bleak collective fiction worldview that is the stock market, a worry about loss of profitability because many workers are getting a little more money plays out one way; over in the many workers world, my extra few bucks plays out another.

Finally the other part of the Fed’s report, indicating that inflation may tick up, is related both to the overall expectation of high wages=spending AND something called “the Fed’s Interest Rate” – the baseline interest that bonds issued by the US Federal Government pay out. This rate is very meaningful because, these bonds being considered the safest investment also form a kind of baseline. Their interest rate forms the bottom of many others, and when it goes up so do other interest rates – like other bond funds and mortgages.

The Fed is supposed to release more information about upcoming increases to the interest rate soon – and we’ll see how “investor fears” react. But remember, there’s no way to know if that’ll drive the stock market up or down.

ABOUT THE ADVICE TO STAY INVESTED

Generally the idea is: Market drops in various sectors are normal. Even drops of 10% – especially when the market has been chugging upwards as long as the current one has. Drops of 5, 10 and 15% are called corrections, and they are apparently just part of the ride. Jumps up of equal amounts are slightly more common, statistically, and so the idea is you want to cruise along catching both because the upward trend is stronger.

Really, drops during good market times and bad?

Betterment shared an analysis on drawdowns (drops) during the best-performing years of the market, concluding that a 5, 10, or 15% drop during a good period is 100% normal.

So why would one stay invested? Because of the part where the market has as much a chance of popping upwards as it does downwards next, and overall missing the few upwards days in an investing lifetime means missing earning most of the money. Womp womp.

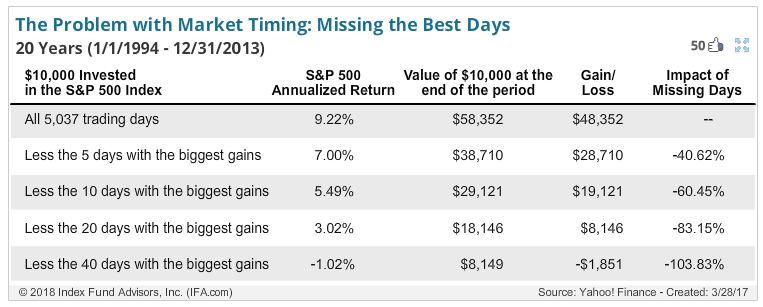

Basically this means don’t try to time the market because you’re going to miss out on the good parts. The folks at Index Fund Advisors share an analysis of market timing and what happens if you do try to time it out:

Betterment also created an infographic explaining how often the market rises after a drop, and how long it takes.

If you watched your retirement/savings drop last week, so did I. It’s really not fun to watch $ go down! Much more un-fun than watching it go up these last many months thanks to loss aversion. Because I personally invest as one strategy to hack capitalism, it’s a weird ride. I both want to have money in my future, and also perversely observe with sadness the behavioral economics of a severely illogical and messed up system.

For me, for my longer term investments (4-30+ years) I’m continuing to put money into indexed investing with about 15% in socially responsible choices. For my short term savings (1.5 years or less) I’m putting into high interest savings and the in-between (1.5-4 years) I’m throwing in a bond heavy index fund (in Betterment, I like that they’re affordable and straightforward ok?).

While I can’t give you investment advice, I can let you know what I think about the recurrent refrain: index funds and chill is a solid strategy, but not an explanation.