Fees & Sliding Scale

Like many consultants, my fees are flexible but need to support me in making this work sustainable. Like many people interested in social justice, I also include fees that are accessible to small organizations and people with less resources. And, like everyone in capitalism and in particular people who’ve experienced generational poverty, I need to make money from my work.

To address this all, I use a sliding scale for some of what I offer. It ranges across circumstances and whether you are an individual/couple, small business, or organization.

Scroll down to learn more and place yourself, or get an idea where your org will fall on the scale. In short, I have a “regular fee” and options to go down or up depending on your access to resources. Where to place yourself on the scale is outlined below. This article I wrote explains sliding scale if you’re not familiar with the idea.

RIDE FREE’S FEES

FEES FOR INDIVIDUALS & PARTNERS

Individuals have the widest range in access to resources, and so in the interest of economic justice I charge individuals on a lower scale than my “professional” fees for businesses. I also recommend that individuals and partners explore the courses and guides for more accessible financial education.

- Group coaching is sliding scale, with options for $80 – $150 – $200.

- 1:1 coaching fees for individuals and partners (business or romantic!) are not sliding scale, and are $205/hour:

- Sessions for individuals working on personal finances: $375 for a one-off consult, or $550 for a 90-minute intake + one session package, $950 for a 4-session package, or $1350 for a 6 session package.

- Partners (2-3 people) working on personal finances: $425 for a two-hour session

- Ongoing check-in sessions are $205 sliding scale for 60 mins and $310 for 90 mins outside of any package pricing.

- 4+ group, housing collectives, and small organizations: $595 regular fee for an intake / planning meeting plus two hours of facilitated strategy session time

- Online courses are $49 – $189, depending on the value and depth of the course content.

- Live class fees are $39-$150 per class, depending on the class. Up to two no-cost seats are available per class, please contact me well ahead of time to enquire about availability.

FEES FOR ORGANIZATIONS

Organization’s fees range based on your budget. I’ll quote based on what you need, the value, and your organizations’ budget size.

I work with smaller nonprofits, public institutions, and large technology companies as a leadership coach, facilitator, trainer, and program/service co-designer. I’m fluent in design thinking and lean entrepreneurship for social impact, with an intersectional // DEI approach.

Reach out to discuss what you are trying to accomplish, and we can create a project to address your needs. Book a free 20-minute consult here to explore working together.

- Consultation fees are:

- Strategic 1:1 session to address organization / business finances: $375 regular fee for an initial 90-minute deep dive, with $200-$400 sliding scale for ongoing work

- Facilitation for organizations is $4,000/day, with $1500-$6,000 sliding scale

- Custom workshops for organizations range a lot ($400 – $8,000+) and are negotiated on a per-request basis.

- Co-design, research, and program development/testing, ranges from $125-$350/hour and is only available as part of larger project work.

Sliding Scale

What does sliding scale mean? It means you select the cost you pay according to what you understand about your financial situation. It’s not simple, and more than just your current income is involved.

For this work to be sustainable for me, on average I need most people to self-select in the regular-fee range. Also, when a few people and organizations with more resources select high/top, that offsets and supports lower sliding scale attendees (for me). This is an experiment, but over the last four years it’s been relatively sustainable.

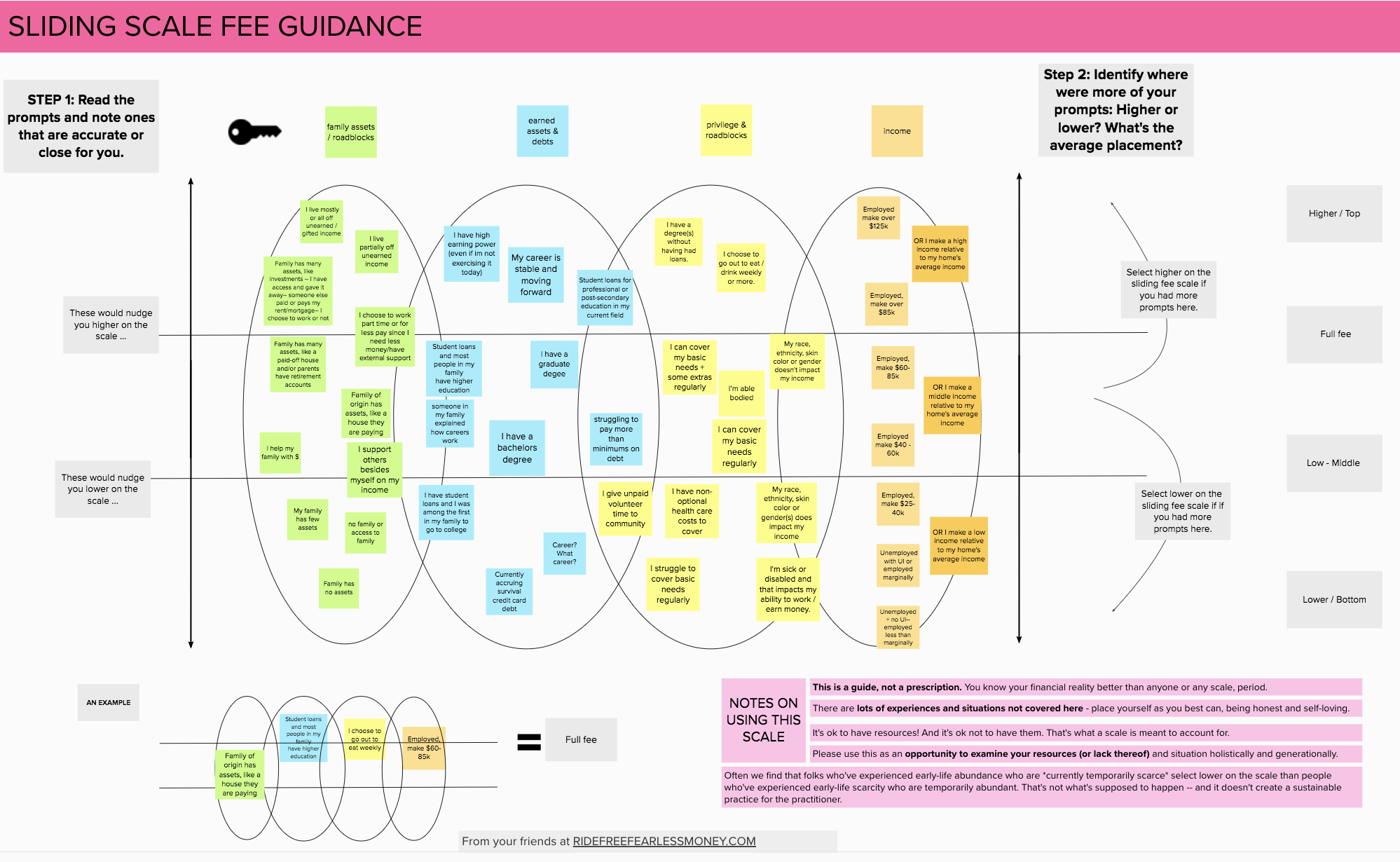

The guide to decide where you land on the sliding scale

EVERYONE’s FINANCIAL REALITY IS COMPLEX. Mine, yours, anyone you can think of.

This is a guide, not a prescription. You know your financial reality better than anyone or any scale, period.

There are lots of experiences and situations not covered here – place yourself as you best can, being honest and self-loving.

It’s ok to have resources! And it’s ok not to have them. That’s what a scale is meant to account for.

Please use this as an opportunity to examine your resources (or lack thereof) and situation holistically and generationally.

Often we find that folks who’ve experienced early-life abundance who are *currently temporarily scarce* select lower on the scale than people who’ve experienced early-life scarcity who are temporarily abundant. That’s not what’s supposed to happen — and it doesn’t create a sustainable practice for the practitioner.

The sliding scale visual guide for individuals:

The areas of sliding-scale self-assessment spelled out, for readability:

- privilege & roadblocks

- earned assets & debts

- Income

- family assets / roadblocks

Below are two ways to assess yourself: by areas of self-assessment and by groupings of the prompts aligned with economic realities.

The prompts spelled out.

Anything true for you towards the beginning of the list moves you towards the top of the sliding scale, and anything towards the end of the list moves you towards the bottom of the sliding scale:

Family assets / roadblocks

- I live mostly or all off unearned / gifted income

- I live partially off unearned income

- My family has many assets, like investments

- I have access and gave it away

- Someone else paid or pays my rent/mortgage

- I can choose to work or not

- I choose to work part time or for less pay since I need less money/have external support

- Family has many assets, like a paid-off house and/or parents have retirement accounts

- Family of origin has assets, like a house they are paying

- I help my family with $

- I support others besides myself on my income

- My family has few assets

- I have no family or access to family

- My family has no assets

Earned assets & debts

- I have high earning power (even if im not exercising it today)

- My career is stable and moving forward

- I have student loans for professional or post-secondary education in my current field that I work in

- I have student loans and most people in my family have higher education

- I have a graduate degee

- Someone in my family explained how careers work

- I have a bachelors degree

- I am struggling to pay more than minimums on debt

- I have student loans and I was among the first in my family to go to college

- Career? What career?

- Currently accruing survival credit card debt

Privilege & roadblocks

- I have a degree(s) without having had loans.

- I choose to go out to eat or drink weekly (or more).

- My race, ethnicity, skin color or gender doesn’t impact my income

- I can cover my basic needs + some extras regularly

- I’m able bodied

- I can cover my basic needs regularly

- I give unpaid volunteer time to community

- My race, ethnicity, skin color or gender(s) does impact my income

- I have non-optional health care costs to cover

- I’m sick or disabled and that impacts my ability to work / earn money.

- I struggle to cover basic needs regularly

Income

- Employed make over $125k

- OR I make a high income relative to my home’s average income

- Employed, make over $85k

- Employed, make $60-85k

- OR I make a middle income relative to my home’s average income

- Employed make $40 – 60k

- Employed, make $25-40k

- OR I make a low income relative to my home’s average income

- Unemployed with UI or employed marginally

- Unemployed + no UI– employed less than marginally

Here’s another way you can use these prompts to imagine where you fall on a sliding scale:

Consider paying on the high/supporter side of the scale if many of the following are true:

- Employed make over $125k OR I make a high income relative to my home’s average income

- I have a degree(s) without having had loans.

- I have high earning power (even if im not exercising it today)

- I live partially, mostly or all off unearned / gifted income

- My family has plentiful assets, like investments

- I recieved a large (over $50k) amount of money and gave/give it away

- Someone else paid or pays my rent/mortgage

- I can choose to work or not

- I choose to work part time or for less pay since I need less money/have external support

Consider paying the full fee if many of the following are true:

- Employed, make over $85k OR I make a middle income relative to my home’s average income

- I choose to go out to eat or drink weekly (or more).

- My race, ethnicity, skin color or gender doesn’t impact my income

- I can cover my basic needs + some extras regularly

- I’m able bodied

- I can cover my basic needs regularly

- I have student loans for professional or post-secondary education in my current field that I work in

- I have student loans and most people in my family have higher education

- I have a graduate degee and am paying off my loans

- Someone in my family explained how careers work

- My career is stable and moving forward

- Family has many assets, like a paid-off house and/or parents have retirement accounts

- Family of origin has assets, like a house they are paying

Consider paying on lower part of the sliding scale if many of the following are true:

- Employed, make $60-85k

- Employed make $40 – 60k

- I’m sick or disabled and that impacts my ability to work / earn money.

- I give unpaid volunteer time to community

- My race, ethnicity, skin color or gender(s) does impact my income

- I have non-optional health care costs to cover

- I have a bachelors degree and am paying off my loans still

- I am struggling to pay more than minimums on debt

- I have student loans and I was among the first in my family to go to college

- I help my family with $

- I support others besides myself on my income

- My family has few assets

- I have no family or access to family

- My family has no assets

Consider looking for free / alternative resources if many of the following are true:

- Employed, make $25-40k or I make a low income relative to my home’s average income

- Unemployed with UI or employed marginally

- Unemployed + no UI– employed less than marginally

- I struggle to cover basic needs regularly

- Career? What career?

- Currently accruing survival credit card debt

Any guide necessarily oversimplifies things for a purpose: helping you find yourself on a sliding scale. Use the guide as best you can, knowing that you’ll need to extrapolate and think through it a bit — which is part of the point

Do you have scholarships or work-trade?

I offer at least one free space per live class, based on need. I don’t do work trade, since lord knows people without resources work extra for everything already. If you’re not able to pay and want to attend a class, please reach out via email at least a few days ahead of time. As donations and registrations support it, I open more no/low-cost seats in a class.

I also give one no-cost consultation per month, through friend/community word of mouth connections, with a focus on supporting lower-income BIPOC folks and unfunded organizations who have a racial justice mission.