I was recently asked,

“I just got offered an AmEx with a bonus of $750 in gift cards if I sign up. I think it is a good idea, but wondering if I should check my own credit score first? If so, is there a place you recommend checking it for free? I am nervous to apply for new credit card, if I might get rejected – cause i know that makes your credit score look even worse.”

CREDIT CARDS

Getting offered a credit card shows your credit is at least not horrible, so this is good. Does the offer say “you’re already approved?” If so, then you don’t have to worry about being denied. Not sure? Call the 1-800 number on the offer.

Having additional lines of credit is good because it lowers your overall debt-to-credit ratio. The more *unused* credit you have, in general, the better. Say for example you have a maxed-out $2000 credit card: you’re debt to credit is 100%, you have nothing left. If you get another credit card with a $2000 limit, you’re immediately at 50%. Your total credit of $4000 is only half-used up.

CREDIT SCORE

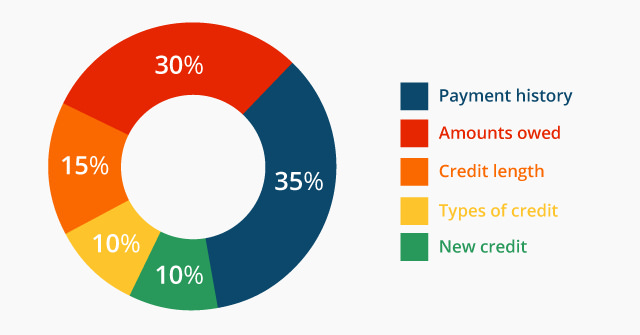

Your credit score, also known as your FICO score, is a number, ranging from 350-850. It’s comprised of the following elements:

Knowing your credit score, what makes up your credit score, and checking it is a fantastic idea — knowledge is power! In general, the credit holder [you] checking your credit once a year is not deleterious to your credit. It shows you’re being proactive. It’s also an opportunity for you to correct errors, should you find them.

You can request a free copy of your credit report from each of three major credit reporting agencies – Equifax, Experian, and TransUnion – once each year through your bank, or via an online service like AnnualCreditReport.com* or call toll-free 1-877-322-8228.

In terms of checking credit & finding your score, there are many online resources to give you info, like this one: https://www.wellsfargo.com/financial-education/credit-management/check-credit-score/

Getting a credit card and checking your own credit both will touch your credit rating with an “account inquiry” – this is a very small amount of points, and as long as you’re not doing so monthly, should not stop you from moving forward on getting credit if you can use it strategically and ideally pay it off each month.

*Friendly web security reminder: Look for HTTPS

Never, EVER, put your social security # or bank login info into a web page if it doesn’t have the “s” in https://www.websitename.com. This indicates there is cryptography protecting your sensitive data.

One thought on “Credit Score + Credit Card”

Comments are closed.