“Money train. Money train. Sometimes I too wanna get on and ride just like you. Sometimes I’m just like you, man. I wanna get on and have a ride. I wanna get on and ride, and take these fakes for every penny they got. Yeah. Yeah.”

– Henry Rollins / Rollins Band, Money Train

Being a financial blogger who happens to also side-eye consumerism and is pretty harsh about capitalism in general, I get around to reading other blogs and recently found a corner of the internet that’s well-established and anti-consumerist. Liking this!

- General attitude that life is about doing things, living, and being with people? Yes.

- Desire to avoid compulsory work? Yes.

- Willing to share accrued resources? Yes.

- Very male dominated? Yes.

Where are we, a hardcore show at an anarchist festival? Nope, we’re in the world of Financial Independence. Friends, I take the journeys and report back so you can enter fully informed.

A lot of these folks credit or move in the footsteps of a book called Your Money or Your Life (YMOYL). Published in 1993 (and updated in 2018!) by Joe Dominguez and Vicki Robin, it espoused a 9-step program, “to transform your relationship with money” but related the transformation to not just getting off an earn/spend/save train, but related these to the time money-related functions take in your life.”

The authors instruct you to do whatever the hell you gotta to do lower your expenses and invest money, to the end that your investment income can cover your expenses. For YMOYL, it’s about getting “enough, not ‘rich’.” Which sounds pretty good to me.

FI/RE

The concept of “Financial Independence” and Retiring Early (FI/RE) was born with this book. It’s defined as “having an income sufficient for your basic needs and comforts from a source other than paid employment.” Translated, it means being wealthy: not having to work. It means you can do what you want in your life, based on having enough money — but they hinge on the fact that you gotta help yourself have that money by not blowing your nest egg on consumer crap. There’s the hitch, since a lot of money gets blown on excess purchases, amirite #shoes?

To say it was widely successful is an understatement. The authors ended up creating an anti-consumerist foundation, the New Road Map, to help explain their concepts of money as life energy and the nine steps to FI — and accrued loads of raving fans who now jump around a crevice of the internet talking about their strategies and successes.

Some of my favorites in the FI world happen to be hugely popular: if you want great writing and cheeky disdain for wasteful consumerism, see Mr. Money Mustache — here he explains the 4% investments rule that RE is all about. Or, check our another blogger, J Money who shares his FI plan online here, while he humanizes the journey by talking about his challenges on the way.

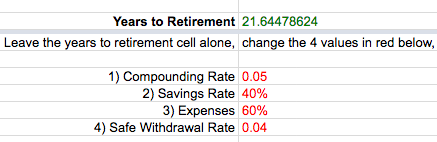

There is a norm in the FI community of sharing tips and tools. (It’s very DIY which I appreciate.) Heck, click on this google sheet or this one, and see if you can’t calculate your FI date* by the savings you can scrape up against your expenses. Or, try this iPhone app to help you track your savings/retirement date. Or this article on how to maximize which kind of IRA account to get the most tax savings, or this one on exactly which investments to put your money in to maximize tax savings. It goes on and on.

I appreciate the “run the numbers” approach to spending/saving/debt payoff decisions, and I admire the critique of unexamined spendiness, agreeing that spending as a proxy for actual joy, connection or otherwise is not just wasteful but a harbinger of our broken society. Being a punk I always want to do as I please — and have set up my life pretty much so I can, including happening to have a job I really like — so the idea of getting to do that because I’ve scraped the money together is alluring.

So what’s the catch?

With these many positives, I’m also trying to touch the undercurrent of what alienates me in this writing. In the two writers I shouted out above, there’s only helpful stories and how-tos. In the forums there’s a lot of posi “You can do it!” and “I’m working hard on this!” +1s. Net positives all around.

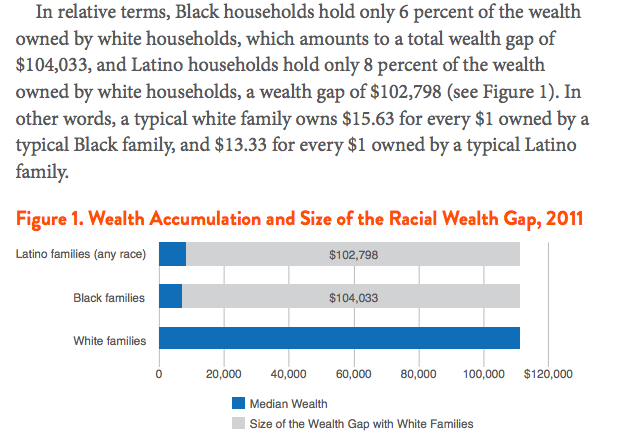

Ultimately, it’s in the aggregate that I find the rub: there’s tons of privilege in the FI world – the subreddit on the topic calls it out at the top, which is right to do. It’s a massively majority caucasian middle-class space, and it’s here that the racial wealth gap shows itself. We’re talking about folks who can work, who can access work that’s well-paying enough to save extra, and who don’t need to put that extra into a family crisis or to address generational precarity. There’s plenty of stories of people who paid off massive student debt in their 20s, but often that’s because there was the privilege to live for free with family to do so. We’re not looking exclusively at white people to be sure, but we sure are looking at a lot of white people. Here’s a little baseline for context:

Is this a criticism of FI in particular?

Nope, ultimately these are math nerds (yay!) who worked hard and got lucky at birth — not in the sense of inheritance, but in the sense that certain people can, as a group, access jobs and income with more ease. It’s a criticism of the underlying imbalances that lead to wealth gaps. It’s a criticism of the historical inequities that have led to the situation in which even realizing you can try to access the education that would get you the job that would allow you to save at the levels needed is is a privilege — and that education is often quite expensive, if available.

What you’re able to save affects where you can end up — this is a core tenant of FI — you have to throw more (like 50, 60, 70% of your earnings) in the bucket to accrue quickly enough to RE. So if you have less to start with and can access less to throw in along the way, the numbers literally just might not work out. Plenty of folks I talk to are working on saving 5% (the US average) with 10% as a goal. MMM’s handy chart linked above will point out that at that savings rate, you’ll retire in 60+ years. Ouch. But if you’re poor or working-class, saving 5-10% literally might be the max you can do. If you make $1.2k a month and need to spend $1.1k to live, it’s a looooong road, which may not have an end.

This is the rub: scale matters. Getting enough is first about getting out of hand-to-mouth and paycheck-to-paycheck realities. In her book Hand to Mouth, Linda Tirado breaks down exactly where the money goes when you’re working for hourly wages and it makes the case that the situation itself is set up to keep people in constant precarity. This is absolutely different than not being able to save because you accidentally had too many glasses of Malbec with pals – again, oops!

Is saving at an FI rate possible?

For some, absolutely. Does education help? Definitely. When my income jumped up after I upgraded my education to get a career, my savings rate went from 15% to 40% of my income. For those of us for whom it is possible, we should consider ourselves not just lucky, but deeply privileged. The appeal of having an end date to compulsory work that’s before I’m 70 (my parent’s retirement age) is glorious, and the strategies of spend less/invest more are structures that — if you can apply them — demonstrate a lot of possibility. In the corner of the blogosphere where I find FI, there’s a lot of awesome ideas, people, and strategies which you can apply if you have a middle class job.

The FI values of accruing enough money to share also appeal to me — with great privilege comes great responsibility, right?

Where does Henry Rollins come in?

I imagine him hanging around in the green room after a show talking about SxE and veganism like they’re givens everyone should do, with a bunch of guys sitting around agreeing with him, talking about The System and their Struggles without asking why they are alone in the room having the conversation. Is the struggle real for everyone, including white men? Heck to the yes! Patriarchy hurts men and white supremacy damages white people and capitalism stunts the rich — in part because these systems make it seem like they’re THE reality when we inhabit our experiences of them.

It bears saying again: reality is not shared, and money is not neutral. My deep hope is for folks who come from extreme challenges to end up like Drake, all “I was trying to get it on my own / working every night … now I’m on a roll / half a million for a show.”

*Apparently I can retire in 22 years, when I’m 60. I’ll take it – and I’m inspired to see if I can take years off that!